K PLUS

K PLUS is a wallet app provided by Kasikorn bank Public Company Limited, one of Thailand’s leading banks and renowned for its leadership in retail banking and digital banking innovation. K PLUS holds the highest market share among all banking apps in Thailand and boasts an impressive user base, with 17 million Active App Users (AAU) and 15 million Monthly Active Users (MAU).

Properties

The following table lists the product properties of K PLUS:

Payment type | Digital wallet | ||

Funding source | Kbank account balance | ||

Acquirer | AntomSG, AntomHK, AntomUS, AntomUK, AntomEU | Merchant entity location | SG, HK, US, EEA, UK |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | Thailand | Partial refund | ✔️ |

Processing currency | THB | Chargeback/Dispute | ❌ |

Minimum payment amount | 1 THB | Refund period | 365 days |

Maximum payment amount | 2,000,000 THB | Time to return payment result | Real-time |

| Default timeout | 14 minutes | ||

User experience

Note: The following payment flows on different terminals are reference only, and represent this payment method's flow on different terminal types. For supported merchants' terminal types, consult Antom Technical Support.

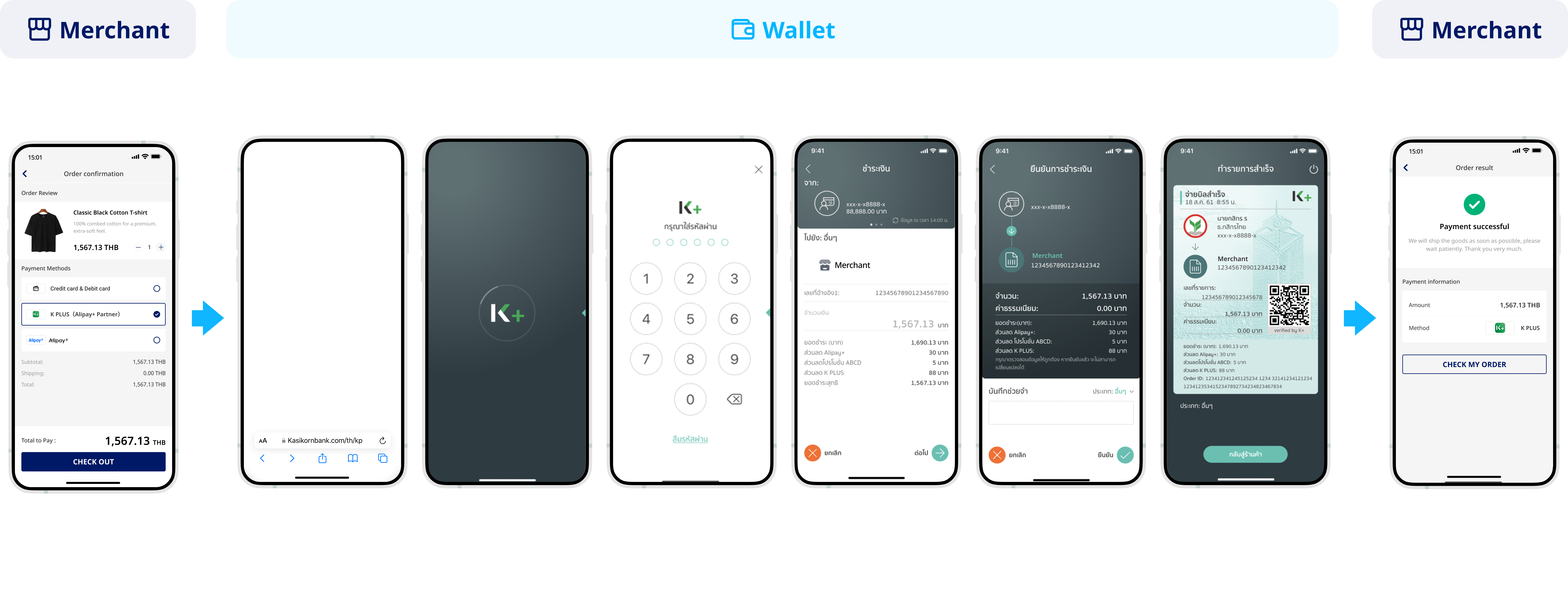

The following figure shows the user experience of paying with K PLUS:

- The buyer selects K PLUS to pay.

- Redirect the buyer to K PLUS app.

- The buyer completes the identity authentication process.

- The buyer confirms the order information.

- The buyer reviews the payment result.

- The buyer is redirected to the merchant result page.

Supported online payment integrations

Antom offers a range of integration options tailored to each payment method. Each payment method may support different online payment integration options, allowing for flexibility based on your business requirements. The table below provides detailed information about the specific integrations available for each payment method:

Supported online payments | Supported integrations | Payment method manual |

One-time Payments | ✔️ API-only ✔️ Web Element ❌ Payment links | |

Auto Debit | ✔️ API-only | |

Subscription Payment | ❌ | None |

EasySafePay | ❌ | None |

Scan to Link | ❌ | None |