BANCOMAT Pay

BANCOMAT Pay is a mobile payment service built on Italy's leading PagoBANCOMAT debit card network, with a market share of between 40% and 60%. Available to over 37 million cardholders, it enables users to make e-commerce, in-store, and peer-to-peer payments via a mobile app. The process is simple and secure: enter a phone number at checkout and confirm the transaction in the app using a PIN, fingerprint, or facial recognition.

Properties

The properties of the BANCOMAT Pay are shown in the following table:

Payment type | Online banking | ||

Acquirer | AntomSG, AntomEU, AntomUS, AntomHK, AntomUK | Merchant entity location | SG, EEA, US, HK, UK |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | Italy | Partial refund | ✔️ |

Processing currency | EUR | Chargeback/Dispute | ✔️ |

Minimum payment amount | 0.01 EUR | Refund period | 365 days |

Maximum payment amount | Unlimited | Time to return payment result | Real-time |

| Default timeout | 1 hour | ||

User experience

Note: The following payment flows on different terminals are reference only, and represent this payment method's flow on different terminal types. For supported merchants' terminal types, consult Antom Technical Support.

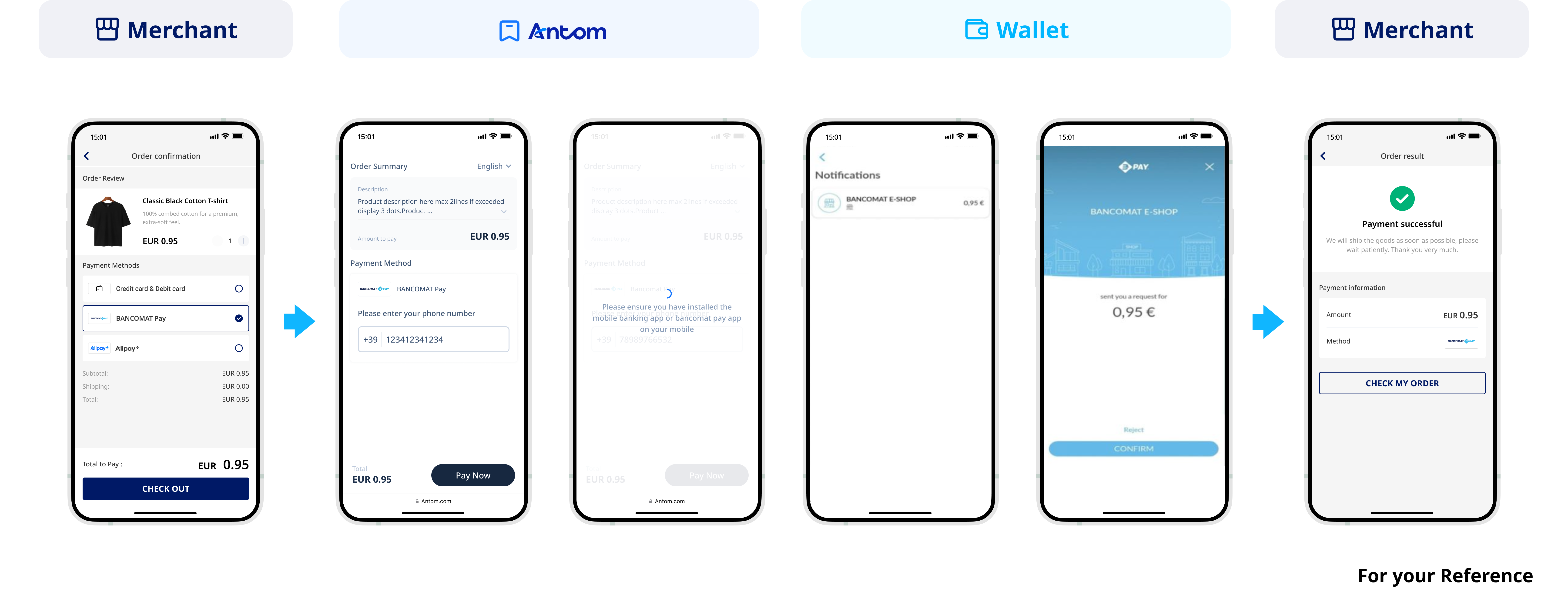

The following figure shows the journey of paying with BANCOMAT Pay:

- The buyer selects BANCOMAT Pay to pay.

- The buyer enters the phone number.

- The buyer receives the payment notification on the BANCOMAT Pay app.

- The buyer confirms the payment result.

- The buyer is redirected to the merchant result page.

Supported online payment integrations

Antom offers a range of integration options tailored to each payment method. Each payment method may support different online payment integration options, allowing for flexibility based on your business requirements. The table below provides detailed information about the specific integrations available for each payment method:

Supported online payments | Supported integrations | Payment method manual |

One-time Payments | ✔️ API-only ✔️ Web Element ❌ Payment links | |

Auto Debit | ❌ | None |

Subscription Payment | ❌ | None |

EasySafePay | ❌ | None |

Scan to Link | ❌ | None |