Touch'n Go eWallet

Touch'n Go eWallet was founded in 2017 by Malaysia's Touch'n Go company. In 1997, the company launched a prepaid rechargeable card that is applicable to motorway tolls and public transport scenarios. The Touch'n Go eWallet now is widely used in various scenarios such as transportation, e-commerce, retail, and utility payment, and is one of the most popular digital wallets in the local area.

Properties

The following table lists the product properties supported by Touch'n Go eWallet:

Payment type | Digital wallet | ||

Funding source | Wallet balance, Go+ | ||

Acquirer | AntomSG, AntomEU, AntomUS, AntomUK, AntomHK | Merchant entity location | SG, HK, EEA, US, UK |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | Malaysia | Partial refund | ✔️ |

| Time to return payment result | Real-time | Chargeback/Dispute | ❌ |

Processing currency | MYR | Refund period | 365 days |

Minimum payment amount | 0.05 MYR | Default timeout | 14 minutes |

Maximum payment amount | 20,000 MYR per transaction; 25,000 MYR per month; 300,000 MYR per year | Supported plugins | ✔️ WooCommerce ✔️ Shopify |

User experience

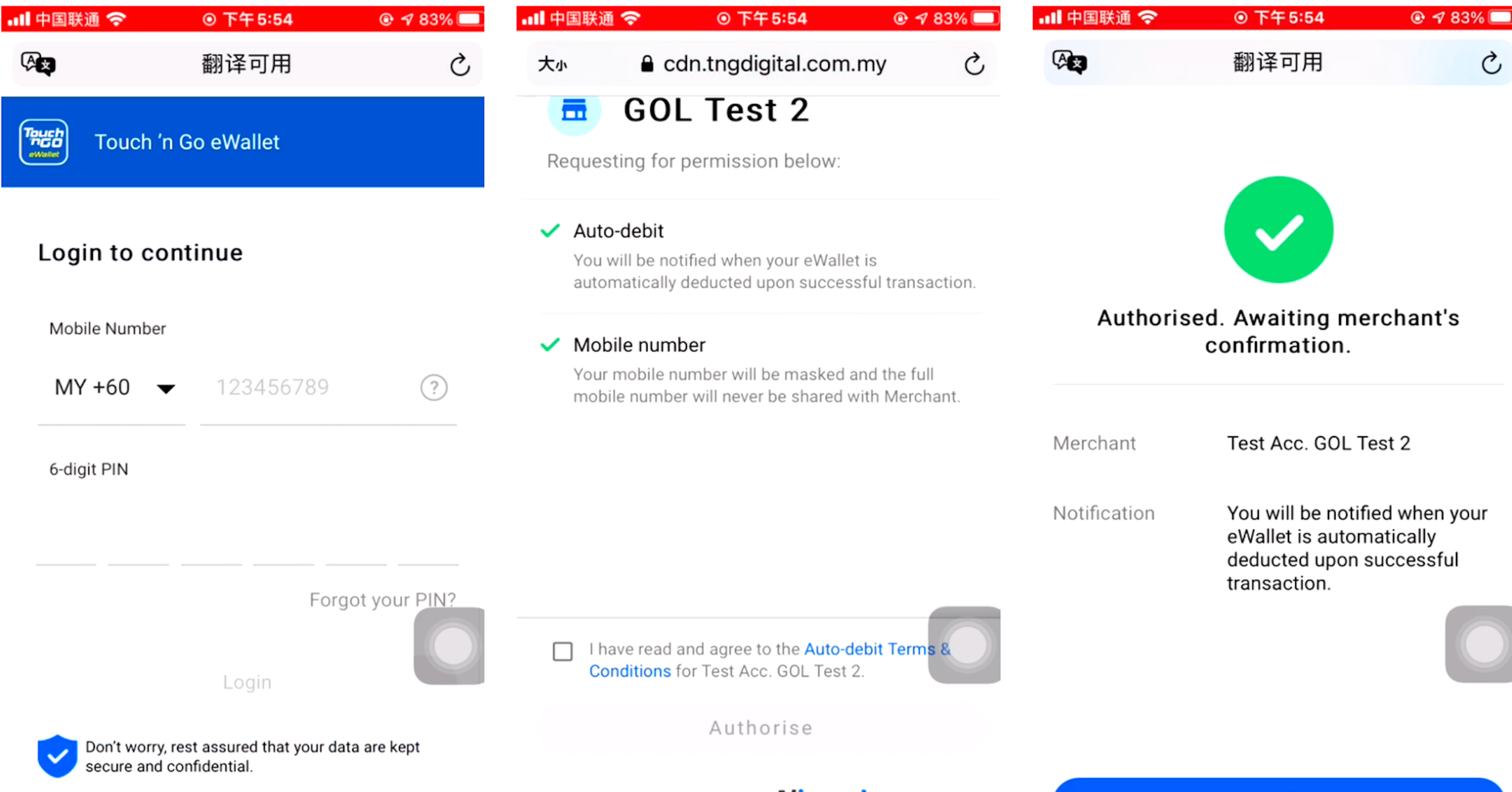

The following graphic shows the Touch'n Go eWallet app authorization process:

Figure 1. Authorization process

Supported online payment integrations

Antom offers a range of integration options tailored to each payment method. Each payment method may support different online payment integration options, allowing for flexibility based on your business requirements. The table below provides detailed information about the specific integrations available for each payment method:

Supported online payments | Supported integrations | Payment method manual |

One-time Payments | ✔️ API-only ✔️ Web Element ✔️ Payment links | |

Auto Debit | ✔️ API-only | |

Subscription Payment | For Acquirer AntomSG: ✔️ API-only | |

EasySafePay | ||

Scan to Link | ✔️ API-only |