ACH Direct Debit

ACH (Automated Clearing House) Direct Debit is a common alternative payment method in the US to cards. It enables funds collection from US bank accounts and is a typically reusable payment method. Compared with instant bank payment, ACH Direct Debit costs significantly less, making it more popular for businesses with large or recurring transactions that don't require instant payments.

To serve increasing demand in open banking payments, Pay by bank (US), powered by Trustly, is a payment method that facilitates direct bank transfers via ACH. During checkout, buyers select their bank from a bank list and are redirected to the bank's portal to authorize the payment. After the first-time payment, buyers' payment info would be saved for subsequent payments, smoothing the payment process for future transactions.

Properties

The following table lists the product properties supported by ACH Direct Debit:

Payment type | Online banking | ||

Acquirer | AntomUS | Merchant entity location | US |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | United States | Partial refund | ✔️ |

Processing currency | USD | Chargeback/Dispute | ❌ |

Minimum payment amount | 0.01 USD | Refund period | 365 days |

Maximum payment amount | 25,000 USD | Time to return payment result | Up to 3 business days |

Default timeout | 7 days | ||

User experience

Note: The following payment flows on different terminals are reference only, and represent this payment method's flow on different terminal types. For supported merchants' terminal types, consult Antom Technical Support.

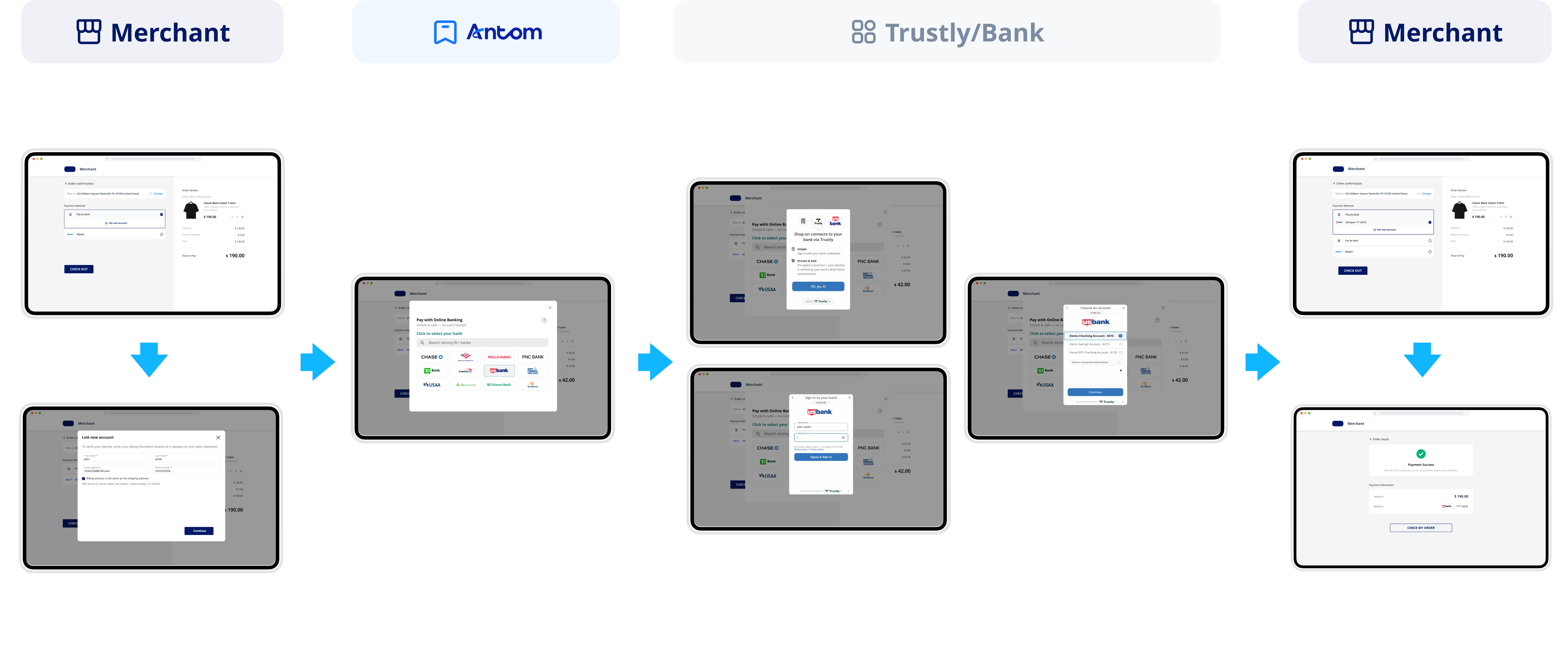

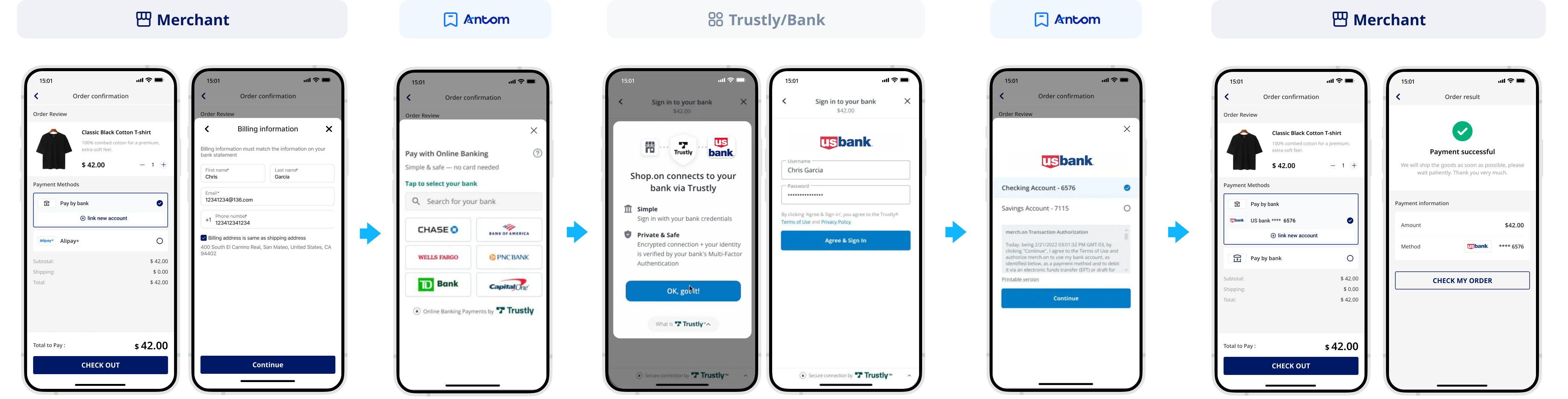

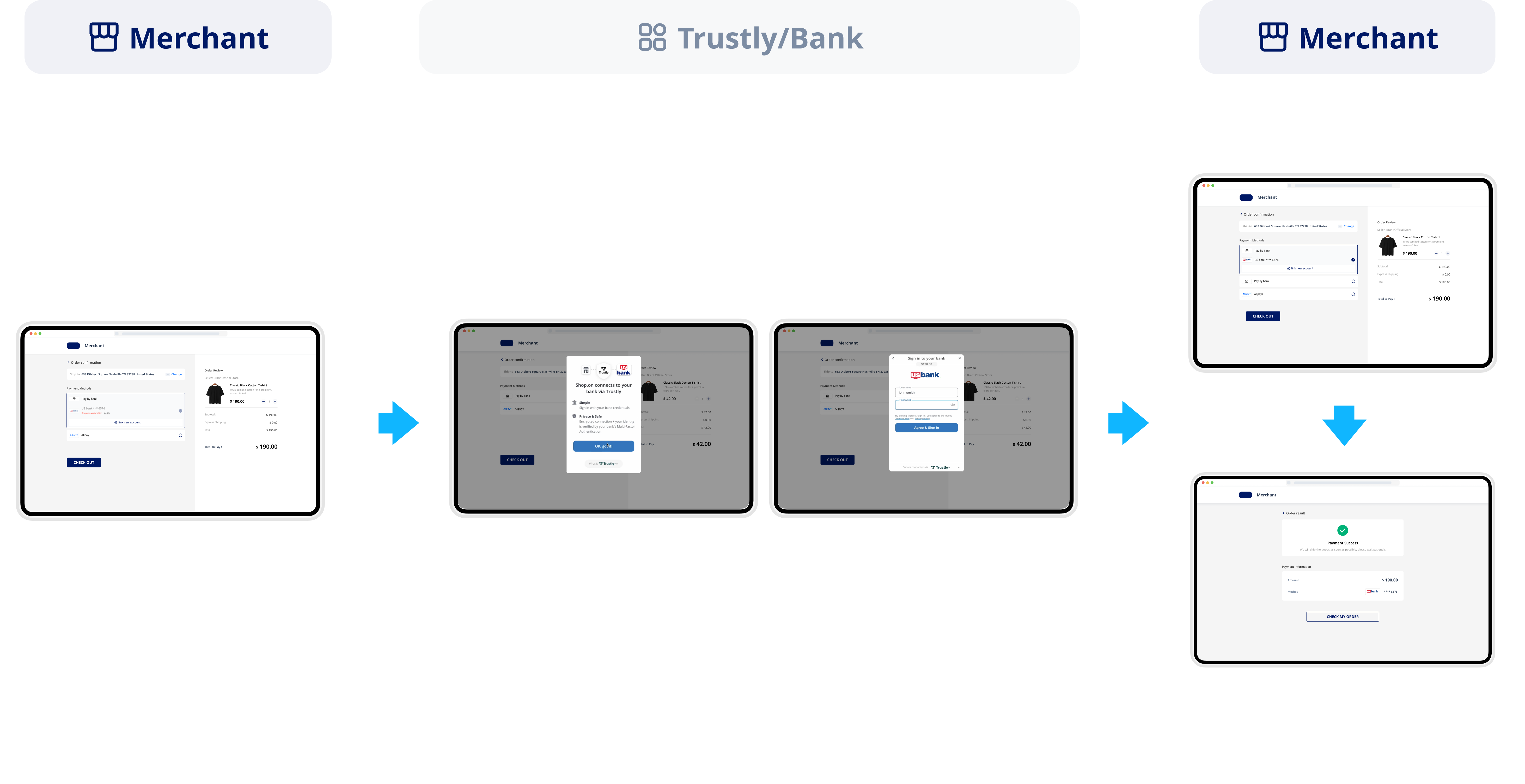

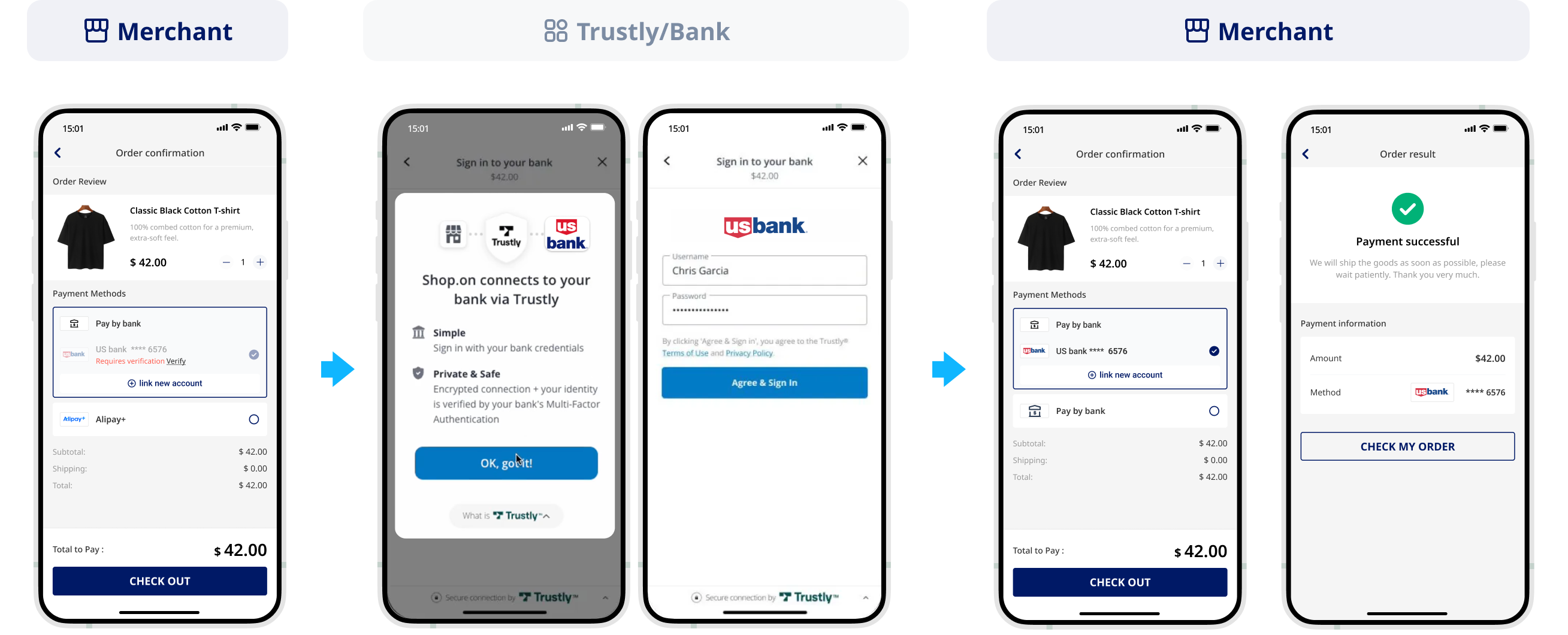

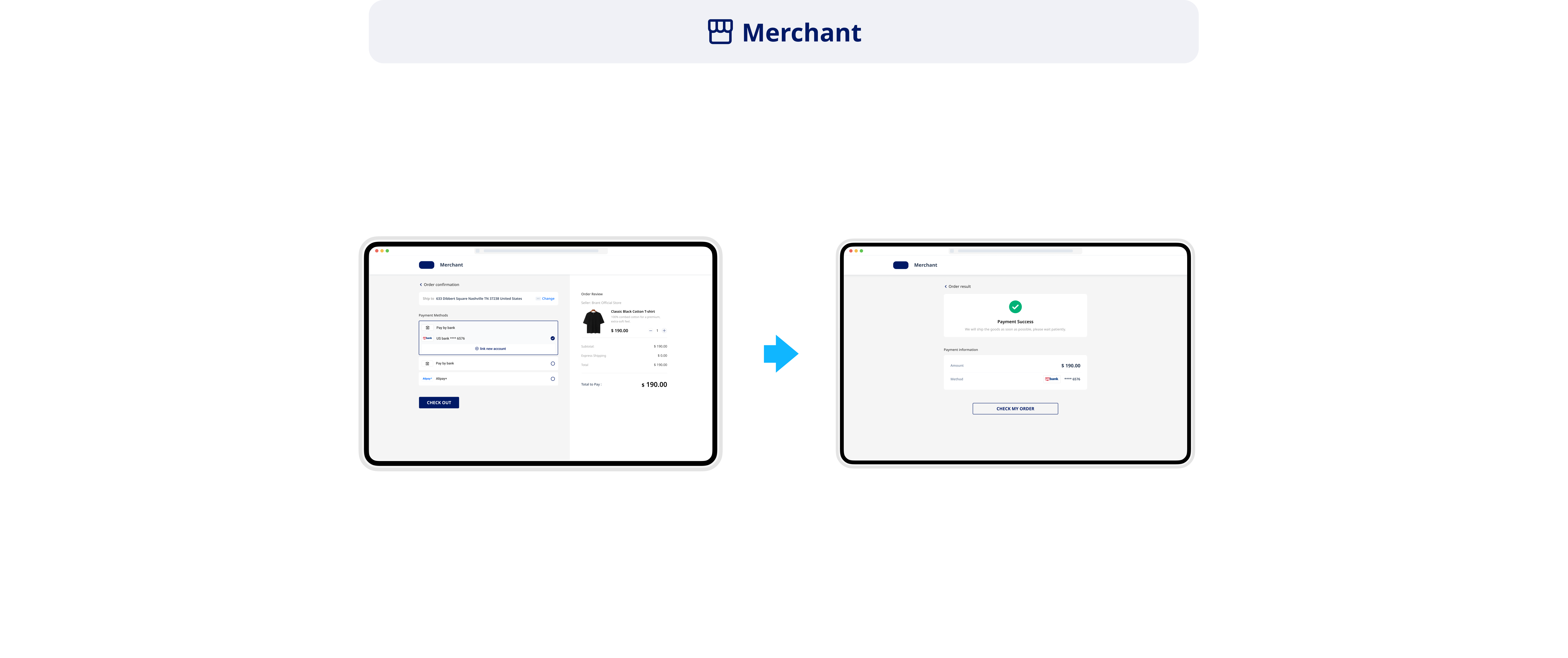

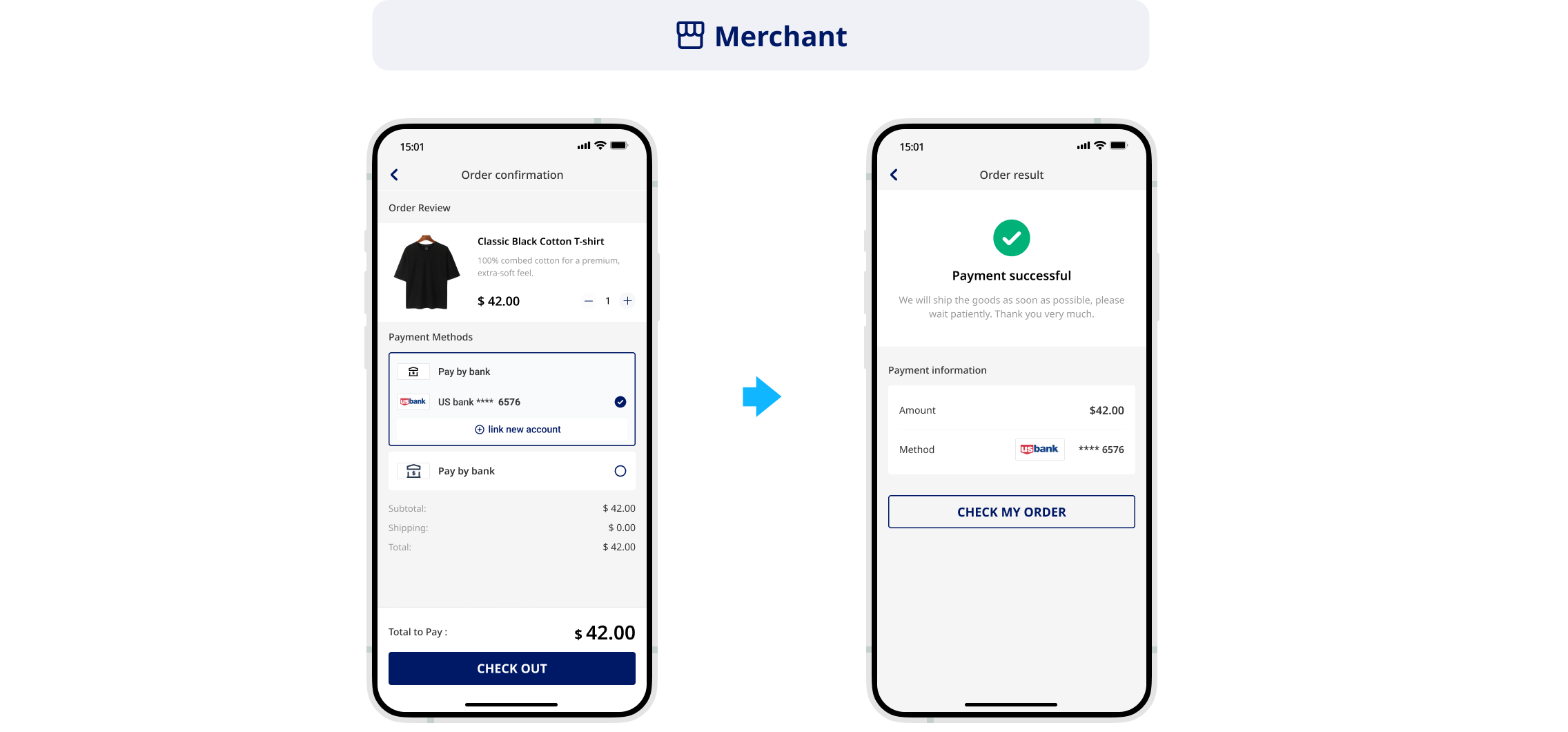

The following figures show the journey of paying with ACH Direct Debit:

First-time payment

- The buyer selects Pay by bank to link a new bank account.

- The buyer enters billing information.

- The buyer selects a specific bank.

- The buyer logs into the bank page to proceed with the verification.

- The buyer inputs credentials to complete the verification.

- The buyer confirms the selection of the bank account[1].

- Automatically redirect the buyer to the merchant page and display the linked bank account.

- The buyer confirms payment details to complete the payment.

[1] The buyer may need to manually switch between the in-app browser/window and bank page, depending on device settings and banks.

Re-authentication payments

- The buyer selects Pay by bank and views the bank account linked previously, then clicks Verify to start reauthentication as required[1].

- The buyer logs into the bank page to proceed with the verification.

- The buyer inputs credentials to complete the verification.

- Automatically redirect the buyer to the merchant page and display the linked bank account.

- The buyer confirms payment details to complete the payment.

[1] The buyer’s account, linked at the time of the first-time payment, will expire if no subsequent payment is made within one year. If the buyer initiates the payment again after more than one year, the account must be re-authenticated.

Subsequent payments

- The buyer selects Pay by bank and views the linked bank account, then initiates the payment directly.

- The buyer confirms payment details to complete the payment.

Supported online payment integrations

Antom offers a range of integration options tailored to each payment method. Each payment method may support different online payment integration options, allowing for flexibility based on your business requirements. The table below provides detailed information about the specific integrations available for each payment method:

Supported online payments | Supported integrations |

One-time Payments | ❌ |

Auto Debit | ✔️ API-only |

Subscription Payment | ❌ |

EasySafePay | ❌ |

Scan to Link | ❌ |