Server-to-server mode

One-time Payments service provides a comprehensive payment solution for websites and applications, supporting seamless integration across multiple scenarios such as desktop and mobile devices. With a single integration, you can quickly access a variety of online payment methods, including digital wallets, online banking transfers, and card payments, effectively reducing technical barriers. Buyers can choose the most convenient and secure payment method based on their preferences, enjoying an enhanced payment experience.

This topic describes how to integrate card payment methods through the server-to-server integration mode, which is suitable for merchants with high requirements for payment process customization. This mode requires that you are PCI qualified. Please provide the relevant materials based on your business needs to complete the verification:

- If your annual card transaction volume is expected to exceed 6 million, complete and submit the PCI Attestation of Compliance (AoC) file for verification.

- If your annual card transaction volume is expected to be below 6 million, complete and submit the PCI DSS Self-Assessment Questionnaires (SAQs) file for verification.

For more information about PCI DSS compliance requirements, see PCI DSS standard.

Note: This solution requires you to collect the buyer's card information independently. You must possess PCI compliance certification—please ensure you have completed PCI validation as required.

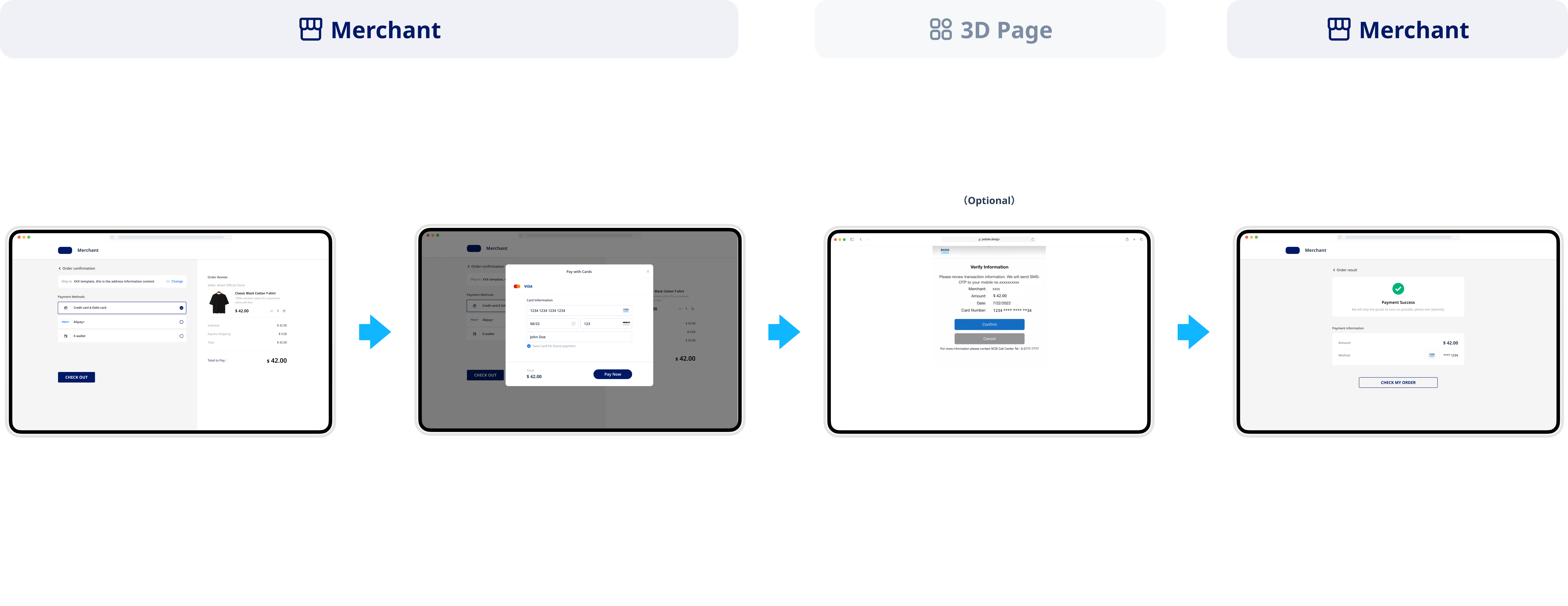

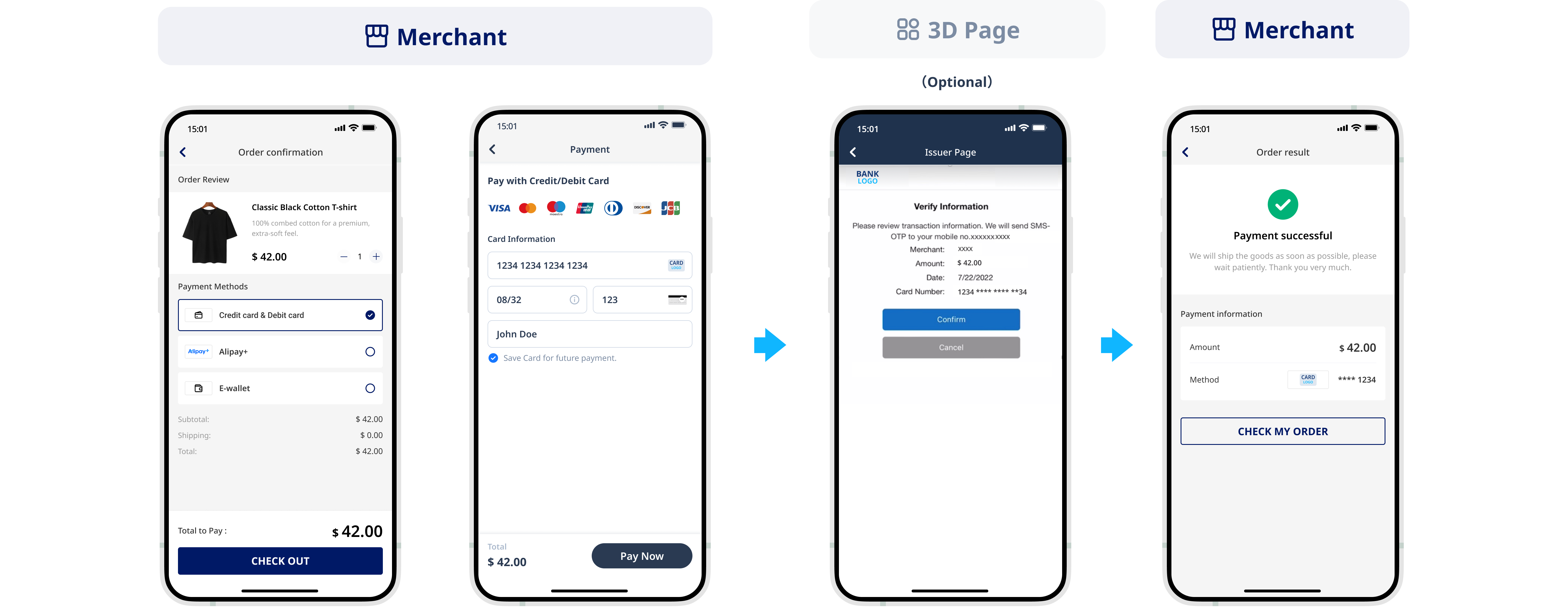

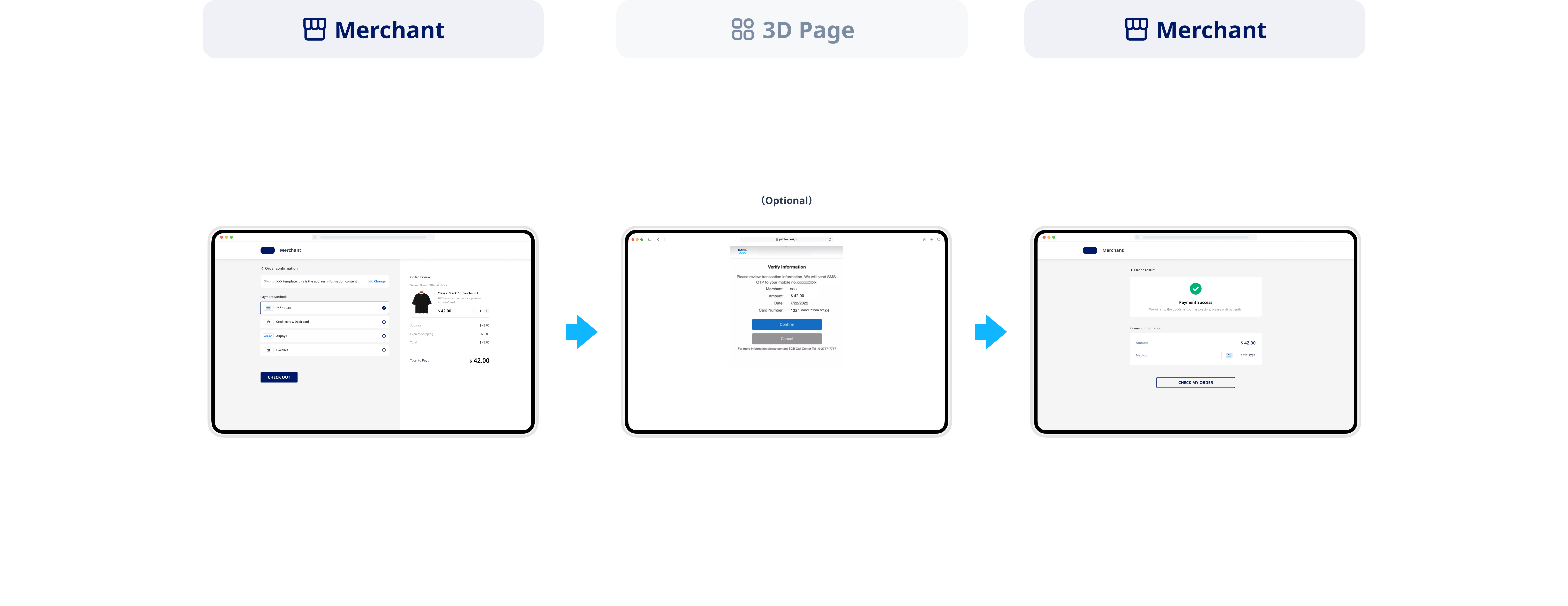

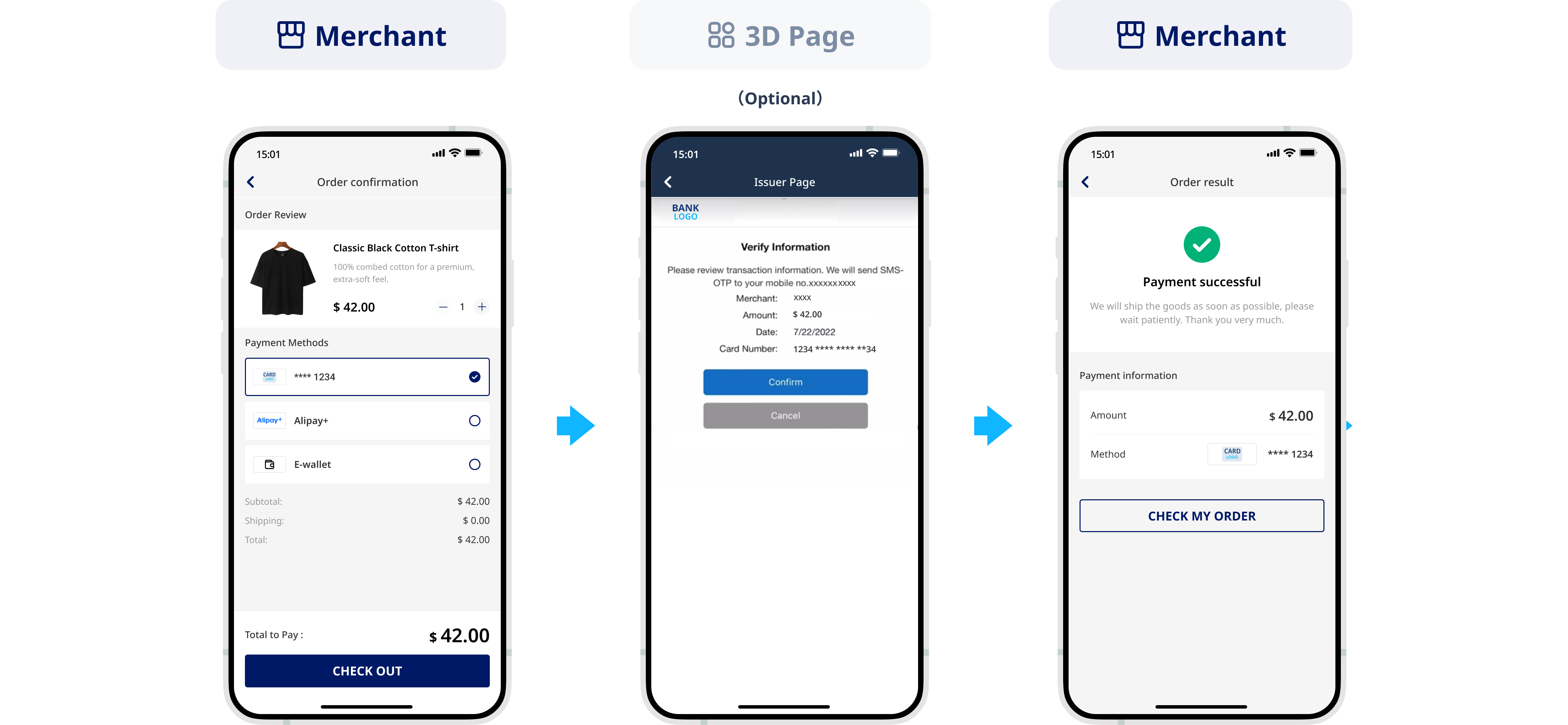

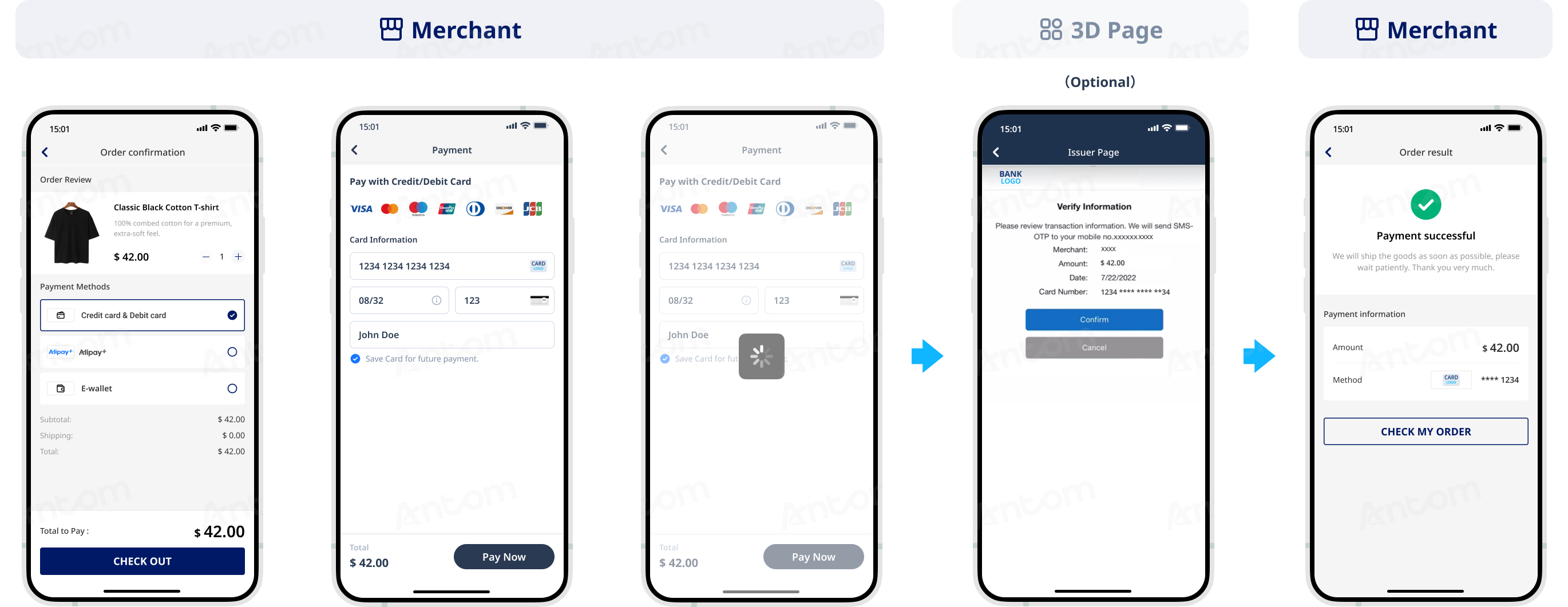

User experience

The following images illustrate the user experience for a buyer's first-time payment or stored card payment:

First-time payment

During the first-time payment, you can prompt the buyer to opt in to save card details. This enables the use of stored card payments, subscription payments, automatic top-ups, and other scenarios in subsequent transactions, providing a faster payment experience and significantly increasing payment intent.

Stored card payment

The buyer can directly select a saved card to complete payment without re-entering payment information.

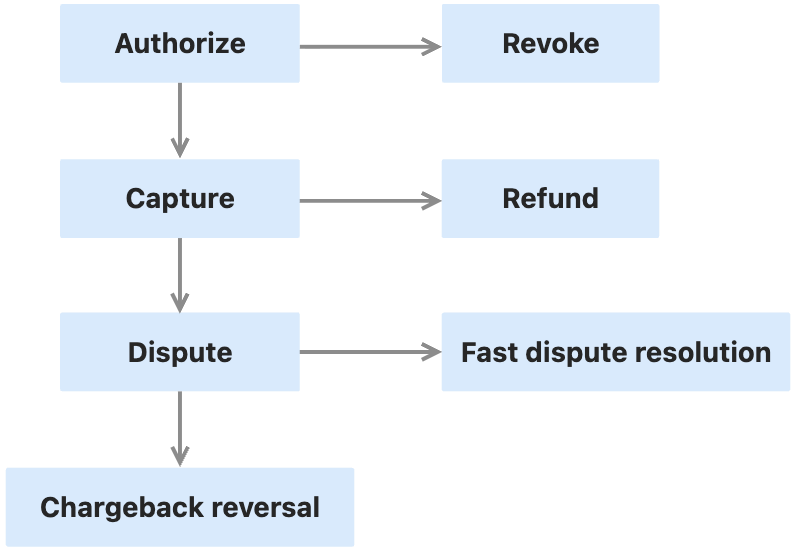

Order lifecycle

A card payment order mainly includes the following stages:

- Authorization: After the buyer completes the payment with a card, the funds will be frozen. You may cancel the order during the window period from when the order is placed until authorization is completed.

- Capture: Capture transfers the buyer’s frozen funds to your account. By default, Antom automatically initiates capture on your behalf. For details, refer to Capture. If capture is completed, you can refund the order within the window period if needed.

- Dispute: If the buyer initiates a chargeback or retrieval request with the card-issuing bank, you will need to manage the dispute process accordingly. For more information, refer to Dispute.

Payment flow

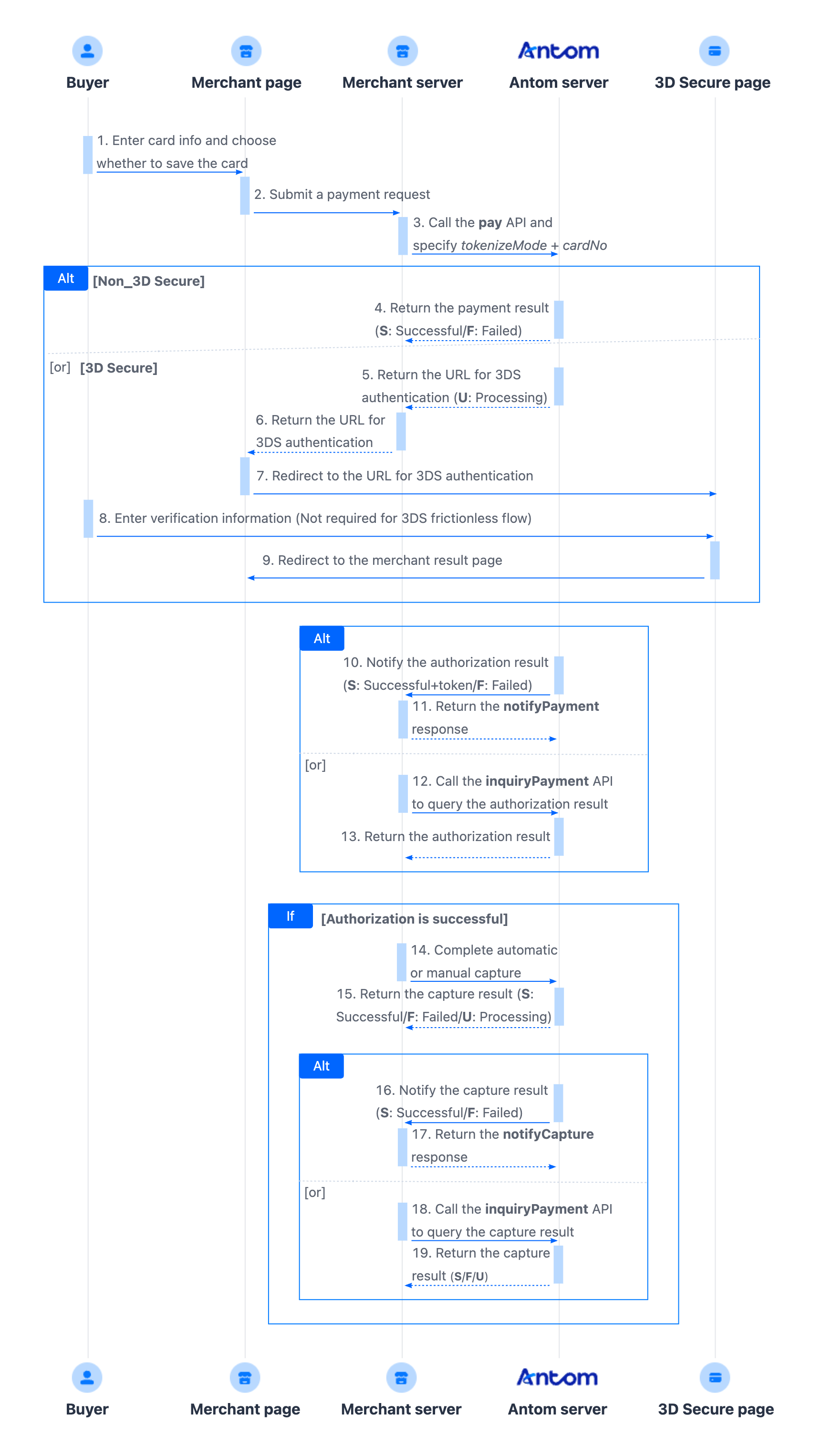

For card payments in the server-to-server mode, the payment flow is composed of the following steps:

- The buyer enters card information and chooses whether to save card for future payments

- Submit the payment request.

After the buyer enters card information and submits payment, you need to call the pay (One-time Payments) API to obtain the payment redirect URL to complete the payment. - (Optional) Redirect the buyer to the 3DS authentication page.

Redirect the buyer to the 3DS authentication page to complete verification (exempted under frictionless flow conditions), and then returns to the merchant’s result page. - Obtain the authorization result.

The merchant server receives the authorization notification returned by Antom and performs corresponding business processing based on the result. - Obtain the capture result.

You can obtain the capture result through either of the following two methods:

- Asynchronous notification: Specify paymentNotifyUrl in the pay (One-time Payments) API or configure on Antom Dashboard to set the address for receiving asynchronous notifications. Upon capture completion, Antom will send you asynchronous notifications via the notifyCapture (One-time Payments) API.

- Synchronous inquiry: Call the inquiryPayment API to check the capture status.

Integration preparations

Before you start integrating, read the Integration Guide and API Overview documents to understand the integration steps of the server-side API and the precautions for calling the API. Furthermore, ensure that the following prerequisites are met:

- Obtain a client ID

- Complete the key configuration

- Complete the configuration of paymentNotifyUrl to receive the asynchronous notification

- Integrate the server-side SDK package, install the server-side library, and initialize a request instance. For more details, refer to Server-side SDKs.

Integration steps

Start your integration by taking the following steps:

- Initiate an authorized payment

- (Optional) Redirect to the 3DS page

- Obtain the authorization result

- Obtain the capture result

Step 1: Initiate an authorized payment

After the buyer submits payment, you need to collect key information such as the buyer's card details, order information, device information, and payment amount, then call the pay (One-time Payments) API to submit the payment request.

The following are key parameters for initiating a payment request:

Type | Parameter name | Required | Description |

Basic parameters | productCode | Yes | In this scenario, the value is fixed as |

paymentRequestId | Yes | The unique ID assigned by the merchant to identify a payment request. Use different ID for each payment request. | |

paymentAmount | Yes | The payment amount that the merchant requests to receive in the order currency. | |

paymentMethod.paymentMethodType | Yes | Payment method enumeration value. For card payment scenarios, this value is fixed as | |

paymentRedirectUrl | Yes | Merchant-side payment result page. It needs to be displayed based on the server-side result, not a fixed success page. | |

paymentNotifyUrl | No | The payment result notification URL, which can be passed in through the API or set as a fixed value through Antom Dashboard. If both are set, the value in the API takes precedence. | |

settlementStrategy | Yes | Settlement strategy for the payment request. If the you have signed up multiple settlement currencies, the settlementCurrency parameter must be specified in the API. | |

paymentFactor.isAuthorization | Yes | Payment mode. For card payment scenarios, the value is fixed as | |

Order parameters | order.buyer | Yes | Buyer information. At least one of the following must be provided:

|

order.referenceOrderId | Yes | The unique ID to identify the order on the merchant side. | |

order.orderDescription | Yes | The summary description of the order on the merchant side. | |

Device parameters | env.terminalType | Yes | Terminal type of which the merchant service applies to. Valid values are:

|

env.osType | No | The operating system type from which the buyer initiated the transaction. Valid values:

| |

env.clientIp | Yes | The IP address of the client device. Required for card payment scenarios. | |

Card payment parameters (Refer to Card payment features) | paymentMethod.paymentMethodMetaData.cardNo | Yes | Card number. In card payment scenarios, if you collect card information yourself, you need to pass this parameter. |

paymentMethod.paymentMethodMetaData.expiryYear | Yes | The year the card expires.In card payment scenarios, if you collect card information yourself, you need to pass this parameter. | |

paymentMethod.paymentMethodMetaData.expiryMonth | Yes | The month the card expires. In card payment scenarios, if you collect card information yourself, you need to pass this parameter. | |

paymentMethod.paymentMethodMetaData.cvv | No | Card verification code (CVV). In card payment scenarios, it is recommended to pass in the CVV information for first-time payments and when using a new card for subsequent payments, as this helps improve payment success rates. For cardToken payments, do not collect CVV again. For more details, refer to Antom Tokenization. | |

paymentMethod.paymentMethodMetaData.cardholderName | Yes | Cardholder name. In card payment scenarios, if you collect card information yourself, you need to pass this parameter to improve payment success rate. This parameter supports only english characters. | |

paymentMethod.paymentMethodMetaData.is3DSAuthentication | No | Determine whether to set the transaction authentication type to 3DS based on risk and dispute history. Valid values are:

|

The above parameters are the basic parameters for creating a payment session, for full parameters and additional requirements for certain payment methods refer to pay (One-time Payments).

The following sample code shows how to call the pay (One-time Payments) API:

public static void payByCardServer2Server() {

AlipayPayRequest alipayPayRequest = new AlipayPayRequest();

alipayPayRequest.setProductCode(ProductCodeType.CASHIER_PAYMENT);

// replace with your paymentRequestId

String paymentRequestId = UUID.randomUUID().toString();

alipayPayRequest.setPaymentRequestId(paymentRequestId);

// set amount

Amount amount = Amount.builder().currency("SGD").value("4200").build();

alipayPayRequest.setPaymentAmount(amount);

// set paymentMethod

PaymentMethod paymentMethod = PaymentMethod.builder().paymentMethodType("CARD").build();

alipayPayRequest.setPaymentMethod(paymentMethod);

// card info

Map<String, Object> paymentMethodMetaData = new HashMap<String, Object>();

paymentMethodMetaData.put("cardNo", "4054695723100768");

paymentMethodMetaData.put("cvv", "123");

paymentMethodMetaData.put("expiryMonth", "12");

paymentMethodMetaData.put("expiryYear", "99");

paymentMethodMetaData.put("tokenizeMode", "ENABLED");

JSONObject cardholderName = new JSONObject();

cardholderName.put("firstName", "John");

cardholderName.put("lastName", "Doe");

paymentMethodMetaData.put("cardholderName", cardholderName);

paymentMethod.setPaymentMethodMetaData(paymentMethodMetaData);

// replace with your orderId

String orderId = UUID.randomUUID().toString();

// set buyer info

Buyer buyer = Buyer.builder().referenceBuyerId("yourBuyerId").build();

// set order info

Order order = Order.builder().referenceOrderId(orderId)

.orderDescription("antom testing order").orderAmount(amount).buyer(buyer).build();

alipayPayRequest.setOrder(order);

// set env info

Env env = Env.builder().terminalType(TerminalType.WEB).clientIp("1.2.3.4").build();

alipayPayRequest.setEnv(env);

// set auth capture payment mode

PaymentFactor paymentFactor = PaymentFactor.builder().isAuthorization(true).build();

alipayPayRequest.setPaymentFactor(paymentFactor);

// replace with your notify url

alipayPayRequest.setPaymentNotifyUrl("https://www.yourNotifyUrl.com");

// replace with your redirect url

alipayPayRequest.setPaymentRedirectUrl("https://www.yourMerchantWeb.com");

// pay

AlipayPayResponse alipayPayResponse = null;

try {

alipayPayResponse = CLIENT.execute(alipayPayRequest);

} catch (AlipayApiException e) {

String errorMsg = e.getMessage();

// handle error condition

}

}The following code shows a sample of the request message:

{

"settlementStrategy": {

"settlementCurrency": "USD"

},

"productCode": "CASHIER_PAYMENT",

"paymentNotifyUrl": "https://www.yourNotifyUrl.com",

"paymentRequestId": "PAY_20**********38",

"paymentRedirectUrl": "https://www.yourMerchantWeb.com",

"paymentFactor": {

"isAuthorization": true

},

"paymentMethod": {

"paymentMethodMetaData": {

"cvv": "682",

"cardholderName": {

"firstName": "Tom",

"lastName": "Jerry"

},

"expiryMonth": "11",

"expiryYear": "28",

"cardNo": "************0849",

"is3DSAuthentication": true

},

"paymentMethodType": "CARD"

},

"paymentAmount": {

"currency": "EUR",

"value": "7000"

},

"order": {

"orderAmount": {

"currency": "EUR",

"value": "30000"

},

"orderDescription": "********ga",

"referenceOrderId": "ORDER_20**********38",

"buyer": {

"buyerEmail": "gaga@gaga.com"

}

},

"env": {

"clientIp": "1.1.1.1",

"osType": "IOS",

"terminalType": "WAP"

}

}The following code shows a sample of the response, which contains the following parameters:

- result.resultStatus: The status of the authorized payment.

- normalUrl: The URL used to redirect to the 3DS authentication page.

{

"normalUrl": "https://pay.xxxx.com/customer-verification?sessionid=103*****KGdFf",

"paymentActionForm": "{\"method\":\"POST\",\"paymentActionFormType\":\"RedirectActionForm\",\"redirectUrl\":\"https://pay.xxxx.com/customer-verification?sessionid=103*****KGdFf\"}",

"paymentAmount": {

"currency": "EUR",

"value": "7000"

},

"paymentCreateTime": "2024-10-11T22:57:16-07:00",

"paymentId": "2024101216********216220539",

"paymentRequestId": "PAY_20**********38",

"paymentResultInfo": {

"avsResultRaw": "",

"cardBrand": "VISA",

"cardNo": "************0849",

"cvvResultRaw": "",

"threeDSResult": {

"cavv": "",

"eci": "",

"threeDSVersion": "2.2.0"

}

},

"redirectActionForm": {

"method": "POST",

"redirectUrl": "https://pay.xxxx.com/customer-verification?sessionid=103*****KGdFf"

},

"result": {

"resultCode": "PAYMENT_IN_PROCESS",

"resultMessage": "paymentinprocess",

"resultStatus": "U"

}

}result.resultStatus | Message | Further action |

| The authorization is successful. | The order can be proceeded with capture, and you need to store paymentId for subsequent capture or refund operations. |

| The authorization failed. | Please close the current transaction or retry with a new paymentRequestId. |

| The authorization is being processed. |

|

Note: If no response is received, it may indicate a network timeout. You can call the inquiryPayment API to query the authorization result, or wait for the asynchronous notification.

Common questions

Q: What is the purpose of paymentId and how should it be used?

A: If you need to store a corresponding order ID for future refunds and reconciliation, you can specify paymentId.

Q: How should I configure the terminalType parameter?

A: The valid values for terminalType are as follows:

WEB: Set terminalType toWEBif the transaction is initiated from a PC.WAP: Set terminalType toWAPif the transaction is initiated from a mobile browser. At the same time, please specify the osType parameter and set it toANDROIDorIOSbased on the buyer’s operating system.APP: Set terminalType toAPPif the transaction is initiated from within a mobile application.Q: Which type of transactions should be set as 3DS transactions?

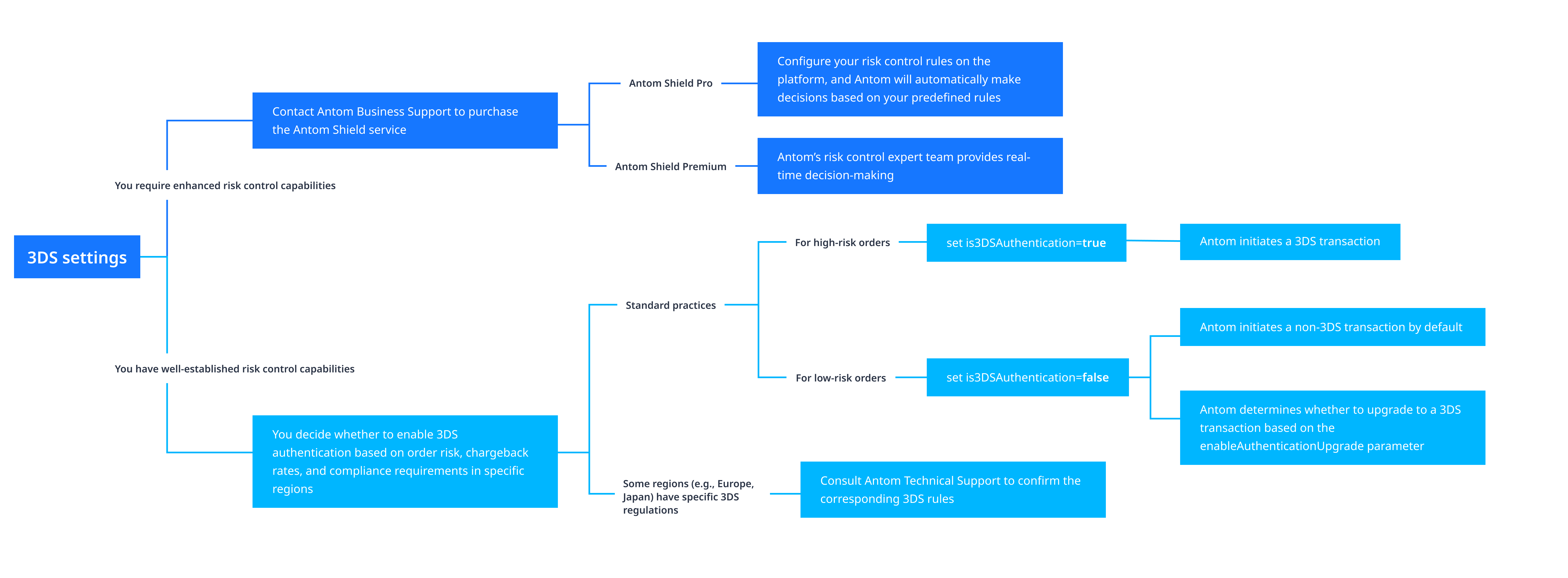

A: If you have purchased Antom Shield, Antom will intelligently determine whether a transaction requires 3DS authentication based on real-time risk models, transaction characteristics, and historical data. If you have robust risk control capabilities, you can decide whether to trigger 3DS authentication based on order risk, chargeback rates, and regional compliance requirements.

Q: If I do not set the is3DSAuthentication parameter, will Antom decide whether to initiate a 3DS transaction on my behalf?

A: No. If the is3DSAuthentication parameter is not set, non-3DS transactions will be initiated by default, which may expose you to risks such as card fraud and chargebacks. Only after purchasing the Antom Shield service will Antom’s risk control model automatically determine whether to apply 3DS authentication. In such cases, you do not need to set the is3DSAuthentication parameter.

(Optional) Step 2: Redirect to the 3DS authentication page

Once the merchant server obtains the normalUrl returned by the response of pay (One-time Payments), it should pass normalUrl to the frontend, which will then redirect the buyer to the 3DS authentication page.

Note: This step is not applicable if the pay (One-time Payments) API returns result.resultStatus with a value of

SorF, as the authorized payment stage has reached its final state.

After obtaining the normalUrl, you need to redirect the page to the 3DS authentication page in a browser or open it in a new tab.

if (serverResponse.normalUrl != null) {

window.open(serverResponse.normalUrl, '_blank');

}Antom server will return different normalUrl values based on the paymentMethod and terminalType parameters you provided. These URLs are used for 3DS authentication (an H5 page), such as https://centinelapi.cardinalcommerce.com/V2/Cruise/StepUp. This page may undergo redirects during the processing flow.

The following images demonstrate the user experience of redirecting to the 3DS authentication page on Web or App platforms.

Common questions

Q: How should I handle the returned 3DS authentication URL?

A: After obtaining the 3DS authentication URL, process it based on your client type as follows:

- Web/WAP: Directly redirect the buyer to the URL.

- App: It is recommended to load the URL using a WebView component within the application.

Please note that while most issuers complete the 3DS authentication process in an H5 page, a few banks may require launching their official app for verification.

Q: How should the payment result page be displayed?

A: The payment result page must be rendered based on the result returned by the server. Do not set the paymentRedirectUrl as a fixed "payment success page", as this URL serves as a universal return endpoint—buyers may be redirected back to the merchant page regardless of whether the payment succeeded or failed.

Q: Does returning to the merchant result page indicate a successful payment?

A: No. Returning to the merchant page alone does not guarantee payment success. Key reasons include:

- Buyers may not be redirected to the result page due to network issues even after successful payment, or they may return manually without completing the payment.

- To prevent security risks such as parameter tampering, Antom does not append any payment result parameters to paymentRedirectUrl.

Q: Is the 3DS redirection URL returned by Antom a fixed domain?

A: No. Since 3DS authentication for card payments redirects to various issuer pages globally, the domains differ. Therefore, setting a fixed allowlist is not feasible. Avoid configuring domain allowlists in WebView.Q: Can an iframe be used to load the 3DS redirection URL for card payments?

A: Due to security policies and compatibility issues with some issuers, it is not recommended to load the 3DS link within an iframe.

Step 3: Obtain the authorization result

After the buyer completes the authorized payment or the payment times out, Antom will send the corresponding authorization results to you through server interaction. You can obtain the authorization result using one of the following methods:

- Receive asynchronous notifications from Antom

- Inquire about the payment result

Receive asynchronous notifications

Follow the steps below to receive and process asynchronous notifications from Antom:

- Configure the webhook URL to receive asynchronous notifications

When an authorized payment succeeds or fails, Antom will send an asynchronous notification to the webhook URL you set. You can choose one of the following two methods to configure the webhook URL for receiving notifications (if both are set, the URL specified in the request takes precedence):

- If each of your orders has a unique notification URL, it is recommended to set the webhook URL in each request. You can pass the asynchronous notification receiving URL for the specific order through paymentNotifyUrl in the pay (One-time Payments) API.

- If all your orders share a unified notification URL, you can set the webhook URL on Antom Dashboard through Developer > Notification URL. For detailed steps, refer to Notification URL.

Note:

- If the buyer does not complete identity verification after being redirected to the 3DS authentication page, Antom sends asynchronous notifications only after the order is closed. The default order closure time is 14 minutes.

- In certain failure scenarios (such as parameter abnormalities), the pay (One-time Payments) API will synchronously return

F(Failure) status in the response. In such cases, Antom will not send asynchronous notifications. You can close the order directly based on theFstatus.

The following code shows a sample of the asynchronous notification request:

{

"actualPaymentAmount": {

"currency": "EUR",

"value": "7000"

},

"notifyType": "PAYMENT_RESULT",

"paymentAmount": {

"currency": "EUR",

"value": "7000"

},

"paymentCreateTime": "2024-10-08T20:34:29-07:00",

"paymentId": "20*********************96",

"paymentRequestId": "PAY_20**********38",

"paymentResultInfo": {

"avsResultRaw": "",

"cardBrand": "MASTERCARD",

"cardNo": "41************54",

"cvvResultRaw": "",

"funding": "CREDIT",

"issuingCountry": "CN",

"paymentMethodRegion": "GLOBAL",

"threeDSResult": {

"cavv": "",

"eci": ""

}

},

"paymentTime": "2024-10-08T20:34:33-07:00",

"result": {

"resultCode": "SUCCESS",

"resultMessage": "success.",

"resultStatus": "S"

}

}The following table shows the possible values of result.resultStatus in the notification request of authorization result. Please handle the result according to the guidance provided:

result.resultStatus | Message | Further action |

| Authorization was successful. | The order can be proceeded with capture, and you need to store paymentId for subsequent capture or refund operations. |

| Authorization failed. | Please close the current transaction or submit a new order with a different paymentRequestId. |

- Verify the asynchronous notification

When you receive an asynchronous notification from Antom, you are required to return the response in the Sample code format, but you do not need to countersign the response.

You need to verify the signature of the authorization payment notification sent by Antom:

import javax.servlet.http.HttpServletRequest;

import org.springframework.http.ResponseEntity;

import org.springframework.web.bind.annotation.PostMapping;

import org.springframework.web.bind.annotation.RequestBody;

import org.springframework.web.bind.annotation.RestController;

import com.alipay.global.api.model.Result;

import com.alipay.global.api.model.ResultStatusType;

import com.alipay.global.api.response.AlipayResponse;

import com.alipay.global.api.tools.WebhookTool;

@RestController

public class PaymentNotifyHandleBySDK {

/**

* alipay public key, used to verify signature

*/

private static final String SERVER_PUBLIC_KEY = "";

/**

* payment result notify processor

* using <a href="https://spring.io">Spring Framework</a>

*

* @param request HttpServletRequest

* @param notifyBody notify body

* @return

*/

@PostMapping("/payNotify")

public Object payNotifyHandler(HttpServletRequest request, @RequestBody String notifyBody) {

// retrieve the required parameters from http request.

String requestUri = request.getRequestURI();

String requestMethod = request.getMethod();

// retrieve the required parameters from request header.

String requestTime = request.getHeader("request-time");

String clientId = request.getHeader("client-id");

String signature = request.getHeader("signature");

Result result;

AlipayResponse response = new AlipayResponse();

try {

// verify the signature of notification

boolean verifyResult = WebhookTool.checkSignature(requestUri, requestMethod, clientId, requestTime, signature, notifyBody, SERVER_PUBLIC_KEY);

if (!verifyResult) {

throw new RuntimeException("Invalid notify signature");

}

// deserialize the notification body

// update the order status with notify result

// respond the server that the notification is received

result = new Result("SUCCESS", "success", ResultStatusType.S);

} catch (Exception e) {

String errorMsg = e.getMessage();

// handle error condition

result = new Result("ERROR", errorMsg, ResultStatusType.F);

}

response.setResult(result);

return ResponseEntity.ok().body(response);

}

}Whether the payment is successful or not, each notification request must be responded to in the format specified below. Otherwise, Antom will resend the asynchronous notification.

{

"result": {

"resultCode": "SUCCESS",

"resultStatus": "S",

"resultMessage": "success"

}

}Common questions

Q: When will the notification be sent?

A: It depends on whether the payment is completed:

- If the payment is successfully completed, Antom will send you an asynchronous notification within 3 to 5 seconds.

- If the payment is not completed, Antom needs to close the order first before sending an asynchronous notification. The time it takes for different payment methods to close the order varies, usually defaulting to 14 minutes.

Q: Will the asynchronous notification be re-sent?

A: Yes, the asynchronous notification will be re-sent automatically within 24 hours for the following cases:

- If you didn't receive the asynchronous notification due to network reasons.

- If you receive an asynchronous notification from Antom, but you did not respond to the notification in the Sample code format.

The notification can be resent up to 8 times or until a correct response is received to terminate delivery. The sending intervals are as follows: 0 minutes, 2 minutes, 10 minutes, 10 minutes, 1 hour, 2 hours, 6 hours, and 15 hours.

Q: When responding to an asynchronous notification, do I need to add a digital signature?

A: If you receive an asynchronous notification from Antom, you are required to return the response in the Sample code format, but you do not need to countersign the response.

Q: Do I need to verify the signature upon receiving an authorization payment result notification?

A: Yes. Signature verification is necessary to ensure that the request was sent to you by Antom. When performing verification, the assembled message must strictly adhere to the following format:

<http-method> <http-uri> <client-id>.<request-time>.<request-body>. For the<request-body>part, you must use its original, unprocessed string value.

Q: Can the value

Sfor resultStatus in the asynchronous notification be used as the basis for shipping goods?A: No. Card payments involve two stages: authorization and capture. The resultStatus in the asynchronous notification only reflects the authorization result. The decision to ship goods should be based on the capture result.

Inquire about the result

You can also inquire about the authorization result by calling the inquiryPayment API using paymentRequestId from the payment request.

The following sample code shows how to call the inquiryPayment API:

public static void inquiryPayment() {

AlipayPayQueryRequest alipayPayQueryRequest = new AlipayPayQueryRequest();

// replace with your paymentRequestId

alipayPayQueryRequest.setPaymentRequestId("yourPaymentRequestId");

AlipayPayQueryResponse alipayPayQueryResponse = null;

try {

alipayPayQueryResponse = CLIENT.execute(alipayPayQueryRequest);

} catch (AlipayApiException e) {

String errorMsg = e.getMessage();

// handle error condition

}

}The following sample code shows a request message:

{

"paymentRequestId": "paymentRequestId01"

}The following sample code shows a response message:

{

"actualPaymentAmount": {

"currency": "USD",

"value": "5000"

},

"authExpiryTime": "2024-12-17T21:56:56-08:00",

"cardInfo": {

"cardBrand": "VISA",

"funding": "CREDIT",

"issuingCountry": "US"

},

"paymentAmount": {

"currency": "USD",

"value": "5000"

},

"paymentId": "20************56",

"paymentMethodType": "CARD",

"paymentRedirectUrl": "http://gol.alipay.net:8080/amsdemo/result?paymentRequestId=amsdmpay_yanfei_wzh_20240111_191505_666",

"paymentRequestId": "paymentRequestId01",

"paymentResultCode": "SUCCESS",

"paymentResultInfo": {

"avsResultRaw": "M",

"cardBrand": "VISA",

"cardNo": "************9954",

"cvvResultRaw": "U",

"funding": "CREDIT",

"issuingCountry": "US",

"networkTransactionId": "12********ew",

"paymentMethodRegion": "GLOBAL",

"threeDSResult": {

"cavv": "",

"eci": ""

}

},

"paymentResultMessage": "success.",

"paymentStatus": "SUCCESS",

"paymentTime": "2024-12-10T21:56:57-08:00",

"result": {

"resultCode": "SUCCESS",

"resultMessage": "success.",

"resultStatus": "S"

}

}The following table shows the possible values of paymentStatus in the response message. Please handle the result according to the guidance provided:

paymentStatus | Message | Further action |

| Authorization was successful. | The order can be proceeded with capture. |

| Authorization failed. | Please close the current transaction or submit a new order with a different paymentRequestId. |

| Authorization is being processed. | Please continue querying or confirm the final status by querying again after the order closure time. |

Common questions

Q: What key parameters should I pay attention to when using the inquiryPayment API to check the authorization status?

A: Please note the following key parameters:

- paymentStatus: Indicates the authorization status of the order.

- paymentAmount: Indicates the payment amount, which can be used for amount verification.

- result: Only indicates the result of the API call. The actual authorization result should be determined based on the value of paymentStatus (

SUCCESSandFAILindicate final authorization results, whilePROCESSINGindicates the authorization is still being handled).Q: How often should I call the inquiryPayment API?

A: Begin polling immediately after calling the pay (One-time Payments) API, and poll constantly with an interval of 2 seconds until the final payment result is obtained or an asynchronous authorization result notification is received.

Step 4: Obtain the capture result

After successful authorization, Antom will automatically initiate capture for you, while you can also initiate capture manually. After capture, you can obtain the capture result either via asynchronous notification or active query. You should decide whether to ship goods based on the capture result. For specific operations, refer to Capture.

After payments

After completing the payment, you can perform the following actions:

Cancellation

In card payment scenarios, Antom supports transaction cancellation (void) under the following three conditions to release frozen funds:

- If a transaction is successfully authorized but automatic capture fails, Antom will automatically void the transaction after 7 days. You may also proactively cancel the transaction to prevent the buyer’s funds from being frozen for 7 days.

- If you capture manually but decide not to proceed with capturing an authorized order, you can call the cancel API to cancel the transaction and immediately release the funds.

- For transactions where authorization was not completed, you can call the cancel API to cancel the transaction directly to prevent duplicate charges.

Refer to Cancel for more details.

Common questions

Q: Can an order be canceled after successful capture?

A: No. Once an order is successfully captured, it cannot be canceled. If you need to process the funds for this order, please initiate a refund. For specific procedures, refer to Order lifecycle.

Q: Will an authorized order be automatically canceled if no capture is initiated?

A: Yes. For an authorized order, capture must be initiated within 7 days. Otherwise, Antom will automatically void the order to release the funds, without requiring you to call the cancel API. To prevent the buyer's funds from being frozen for 7 days, it is recommended to proactively call the cancel API to release the funds in advance.

Refund

Different payment methods have varying refund capabilities. To learn about Antom refund rules and how to initiate a refund for a successful transaction, refer to Refund.

Dispute

Antom provides dispute resolution services for contested transactions. For more information, refer to Dispute Guidance.

Best practices

The following best practices help you optimize the integration process and improve development efficiency:

- API timeout setting: Configure the pay (One-time Payments) API timeout to at least 10 seconds and implement timeout retry logic to synchronously obtain payment results or redirection URLs required for 3DS authentication.

- Merchant result page display: Use the successful capture result as the only basis for shipping goods and displaying payment outcomes.

Payment method features

This section introduces the key parameters when integrating different card brands. The server-to-server mode supports the following card payment features, click to get detailed information and usage instructions:

- 3D Secure 2

- Antom 3DS-Retry

- MIT (Merchant-Initiated Transaction)

- Installment payments

- Antom Tokenization

- COF (Card-on-File)

- Co-badged cards

International cards

The following table lists the key parameters for processing payments with international cards such as Visa, Mastercard, American Express, Cartes Bancaires, Diners, Discover, JCB, and UnionPay:

Parameter name | Description | Remark |

paymentMethod.paymentMethodMetaData.cardNo | Plaintext card number. Collected by the merchant from the buyer. | Required |

paymentMethod.paymentMethodMetaData.expiryYear | Card expiration year. Format: two-digit year (e.g., | Required |

paymentMethod.paymentMethodMetaData.expiryMonth | Card expiration month. Format: two-digit month (e.g., | Required |

paymentMethod.paymentMethodMetaData.cvv | Card Security Code (CVV). | Recommended for first-time payments; do not pass in for COF scenarios. |

paymentMethod.paymentMethodMetaData.cardholderName | Cardholder name. Only English names are supported. | Required |

paymentMethod.paymentMethodMetaData.billingAddress | Billing address associated with the cardholder's account. | Optional (Recommended for |

Local cards

The following table lists the key parameters for processing payments with local card brands in specific countries/regions:

Parameter name | Description | Required | |||||

South Korean cards | Brazilian cards | Chilean cards | Mexican cards | Peruvian cards | Turkish cards | ||

paymentMethod.paymentMethodMetaData.cardNo | Plaintext card number. Collected by the merchant from the buyer. | Yes | Yes | Yes | Yes | Yes | Yes |

paymentMethod.paymentMethodMetaData.expiryYear | Card expiration year. Format: two-digit year (e.g., | Yes | Yes | Yes | Yes | Yes | Yes |

paymentMethod.paymentMethodMetaData.expiryMonth | Card expiration month. Format: two-digit month (e.g., | Yes | Yes | Yes | Yes | Yes | Yes |

paymentMethod.paymentMethodMetaData.cvv | Card Security Code (CVV). | No | Yes | Yes | Yes | Yes | Yes |

paymentMethod.paymentMethodMetaData.cardholderName | Cardholder name. Only English names are supported. | No | Yes | Recommended | Recommended | Recommended | Yes |

paymentMethod.paymentMethodMetaData.dateOfBirth | Cardholder's date of birth. Format: | Yes (Required for South Korean individual cards) | No | No | No | No | No |

paymentMethod.paymentMethodMetaData.cardPasswordDigest | First two digits of the card payment password. | Yes | No | No | No | No | No |

paymentMethod.paymentMethodMetaData.businessNo | 10-digit business number for corporate cards. | Yes | No | No | No | No | No |

paymentMethod.paymentMethodMetaData.cpf | Brazilian individual taxpayer identification number. | No | Required for cross-border transactions; optional for local transactions | No | No | No | No |

paymentMethod.paymentMethodMetaData.payerEmail | Payer's email address. | No | Yes | Yes | Yes | Yes | No |