Overview

Tokenized Payment provides a quick, secure, and seamless method for buyers to complete one-time or recurring transactions. Once they authorize you as a trusted merchant, payments can be automatically deducted from their account without the need for manual actions.

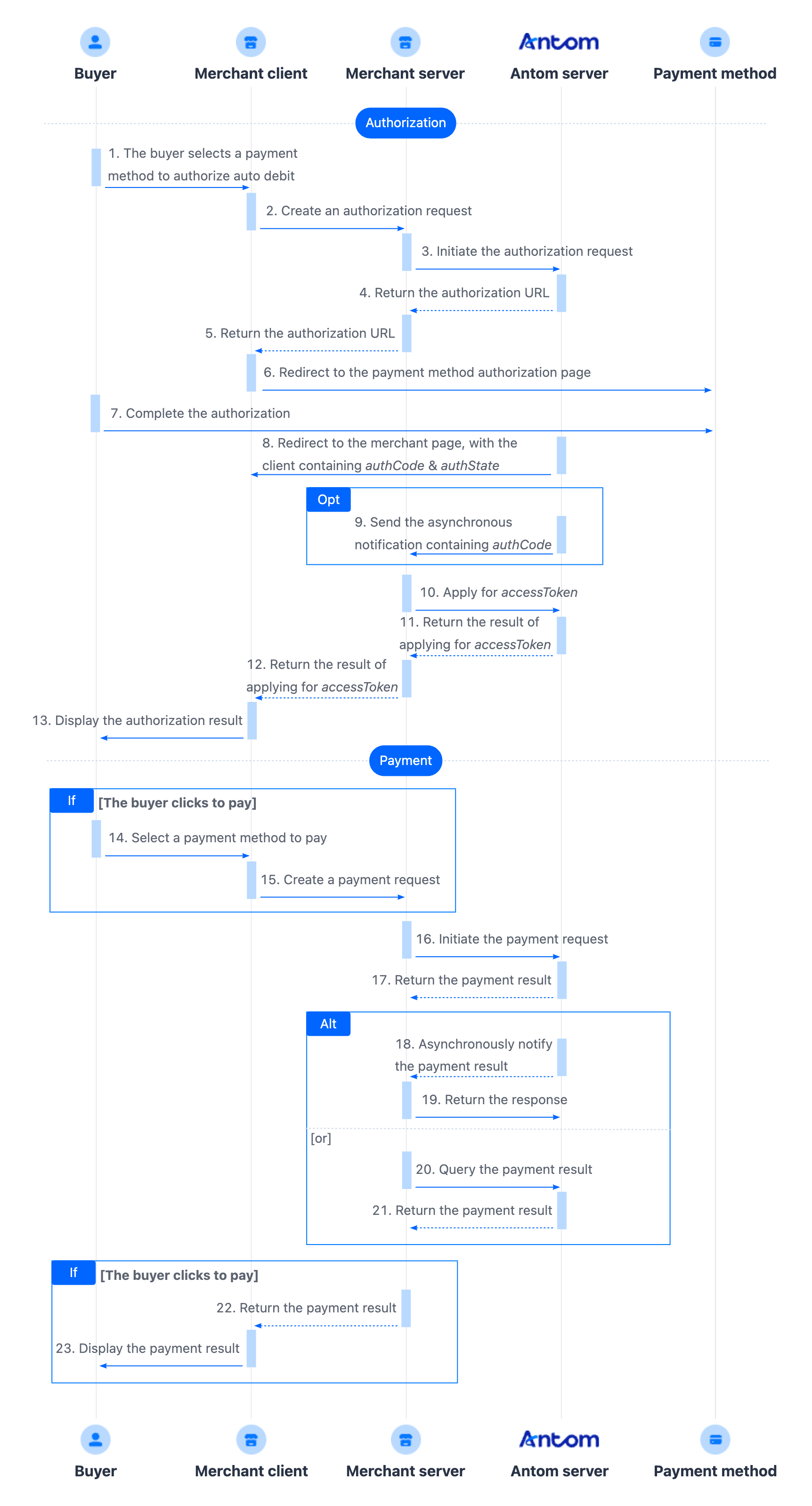

When the buyer makes a purchase on your platform, funds are securely deducted using an access token. This token represents the buyer’s payment details and ensures sensitive information is not exposed during the transaction. You must obtain the buyer’s authorization and apply for the access token in advance before the payment happens. The authorization flow is as follows:

- Buyer initiates the link: On your website or app, the buyer clicks a button such as "Link Account" or "Save for Faster Checkout."

- Buyer grants consent on our secure platform: The buyer is securely redirected to our platform. Here, they will log in to their account and be presented with a clear consent screen asking for their permission to allow your business to initiate payments.

- You receive the access token: Once the buyer grants permission, they are redirected back to your site. Behind the scenes, our system securely passes a reusable access token to your server.

This solution streamlines the payment process, delivering a seamless payment experience for buyers while strictly adhering to the highest security standards. You can benefit from enhanced operational efficiency, improved buyer satisfaction, and higher conversion rates driven by smooth and trusted payment flows.

Product description

Tokenized Payment enables you to access a streamlined, secure, and versatile payment solution, enhancing transaction efficiency, settlement flexibility, and refund management capabilities.

Features

- Secure tokenized payments

Antom's token-based authorized payment solution enables seamless transactions with two simple steps:

- Authorization: The buyer authorizes to tokenize his/her account with the merchant and payment account.

- Payment: The merchant can initiate an auto debit from the buyer's account by calling the pay (Tokenized Payment) API without requiring additional authorization.

Note: Currently, the Tokenized Payment product only supports tokenization for digital wallets, if you require card tokenization capabilities, please note Antom‘s card-on-file feature, including support for Merchant-Initiated Transactions (MIT), is available as part of a separate product offering.

- Payment channel coverage

This solution supports 19 payment methods worldwide, providing extensive global reach for merchants and buyers. For more details, refer to Supported payment methods.

- Settlement capabilities

- An efficient settlement process enables you to receive payments promptly and manage financial operations smoothly.

- Multi-currency settlement supports 24 currencies across 31 countries/regions with competitive exchange rates.

- Local settlement is available in 16 currencies to tailor solutions for regional needs.

- Settlement cycles range from T+2 to T+25 business days, facilitating timely disbursement and cash flow for you.

For more details on settlement capabilities, refer to Settlement rules.

- All-in-one dashboard

Antom Dashboard, a user-friendly online dashboard that empowers you with tools to monitor transactions, settlements, and refunds, while real-time insights and detailed reporting facilitate efficient operations and data-driven decision-making. Get started with receiving online payments in just a few steps.

Advantages

- Extensive payment channel coverage: Antom offers a wide range of payment methods, enabling you to address diversified and rapidly growing buyer needs. This wide coverage enhances accessibility and facilitates global market expansion.

- Exceptional transaction success rate: Antom achieves high payment success rates by applying industry best practices and drawing on insights from years of digital wallet operations and partnerships with leading providers. This results in a smooth onboarding process and frictionless payment experience, ultimately increasing transaction completion and driving revenue growth.

- Secure and convenient tokenized payment mechanism: A one-time authorization creates long-term payment tokens, eliminating the need for repeated authentications. This not only enhances convenience but also safeguards buyer privacy and data security.

- Long validity token: With just a single authorization, payment tokens are issued with extended validity, removing the need for repeated actions in future transactions and greatly enhancing overall payment efficiency.

Benefits

- Rapid market expansion: Broad payment channel coverage allows for quick entry into new markets, especially across the fast-growing Asia-Pacific region, helping you expand your business reach efficiently.

- Revenue growth: High payment success rates minimize losses from failed transactions, directly contributing to increased revenue and improved financial performance.

- Enhanced user experience: A secure and convenient payment mechanism allows buyers to enjoy a seamless payment experience, minimizing payment interruptions and thereby increasing buyer satisfaction and loyalty.

- Efficient conversion and sustained engagement: Long validity payment token technology enables seamless recurring payments, increasing transaction conversion rates and fostering ongoing buyer engagement for continuous revenue opportunities.

User experience

With Tokenized Payment, after the buyer selects a payment method on your platform for the first payment, they will be redirected to the payment method's authorization page to link the payment method to your platform. Once the account is successfully authorized, the buyer returns to your platform to make payment using the authorized account, and you can seamlessly initiate payments from the buyer's authorized payment method account.

Web: QR code-based authorization on PC terminals

Designed for merchants with PC web terminals, this innovative flow utilizes QR codes for authorization, enabling buyers to bind payment methods using their mobile devices easily.

For subsequent payments: The buyer selects the authorized payment method at the checkout page to pay, and the transaction is processed instantly through the QR code without requiring the buyer's re-authorization.

Integration options

Tokenized Payment enables you to build an online automatic deduction feature on your website or application and supports integration on various terminal types (Web/WAP/App). After the buyer completes authorization during the first payment, subsequent payments can be made with just one click or directly deducted by your system without buyer's action.

With a single integration, Tokenized Payment provides access to a wide range of payment methods, including digital wallets and bank transfers. Its seamless payment experience helps reduce buyer loss caused by failed payment deductions. By supporting multiple payment options, it also empowers your business to scale and expand into new markets more effectively.

Payment flow

The authorization and payment flow of Tokenized Payment is outlined below:

- The buyer is directed to the checkout page.

- After the buyer selects a payment method, you need to call the consult API to obtain the authorization URL.

- Obtain the authorization result through the reconstructed URL or through the asynchronous notification from the consult API.

- Call the applyToken API to apply for the payment token (accessToken), and store the corresponding token after obtaining it.

- After obtaining the buyer's authorization, you can initiate the payment by calling the pay (Tokenized Payment) API.

- Obtain the payment result though the asynchronous notification or by calling the inquiryPayment API.

Integration resources

For detailed integration steps on different terminal types (Web/WAP/iOS/Android), refer to Integration guide.

API list

Phase | API | Capability | API endpoint | Mandatory |

Authorization | Obtain the authorization URL | POST | ✔️ | |

Receive authorization result notifications | None | |||

Request for the payment token | POST | ✔️ | ||

Authorization revocation | Invalidate the payment token | POST | ✔️ | |

Payment | Initiate a payment | POST | ✔️ | |

Receive payment result notifications | None | ✔️ | ||

Inquire about the payment result | POST | |||

Cancel the order | POST | |||

Refund | Refund for a successful transaction | POST | Integrate this API based on your business demands. | |

Receive refund result notifications | None | If the refund API is adopted, it is recommended to integrate this API. | ||

Inquire about the refund result | POST | If the refund API is adopted, it is recommended to integrate this API. |

Related tokenized payment services

Unlock the future of payments with EasySafePay by Antom

EasySafePay enables you to quickly and easily build a secure and simple payment experience for your website or application. Buyers can enable password-free payments during their first-time payment without being redirected to the payment method client for authorization. The payment process remains completely within your client, thereby enhancing buyer conversion rates and payment success rates. See Overview and Accept payments to learn more about EasySafePay and its integration.

Currently, the EasySafePay SDK supports the following payment methods: Alipay, AlipayHK, DANA, GCash, and Express Bank Transfer. For details on the payment methods supported by EasySafePay, see Supported payment methods.