Tamara

Founded in Saudi Arabia in late 2020, Tamara is expanding rapidly in the Gulf Cooperation Council (GCC) and is now one of the top major buy now, pay later players in the region. More than supporting installment payments, Tamara is also a shopping tool with built-in in-store catalogs, advertising and promotion solutions, coupled with customer loyalty programs. Therefore, Tamara can help merchants attract customers, boost sales, and save costs.

Properties

The following table lists the product properties supported by Tamara:

Payment type | Buy now pay later | ||

Funding source | Card | ||

Acquirer | AntomSG, AntomUS, AntomUK, AntomEU, AntomHK | Merchant entity location | SG, US, UK, EEA, HK |

Payment flow | Redirect | Refund | ✔️ |

Buyer country/region | Saudi Arabia; United Arab Emirates | Partial refund | ✔️ |

Processing currency | SAR; AED | Chargeback/Dispute | ✔️ |

Minimum payment amount | 1 SAR; | Refund period | 120 days |

Maximum payment amount | No limit | Time to return payment result | Real-time |

User experience

Note: The following payment flows on different terminals are reference only, and represent this payment method's flow on different terminal types. For supported merchants' terminal types, consult Antom Technical Support.

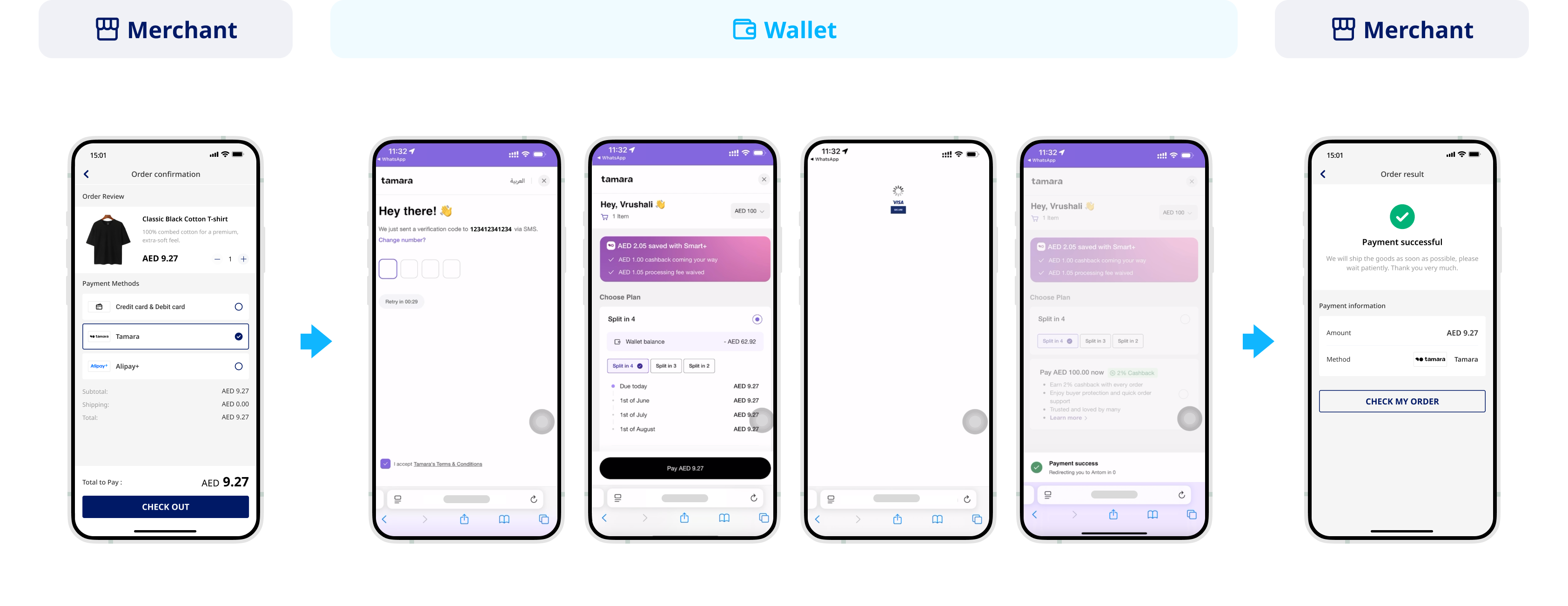

The following graphic shows the user experience of paying with Tamara:

- The buyer selects Tamara to pay.

- The buyer is redirected to the Tamara's mobile browser payment page and logs in with the phone number.

- The buyer enters the OTP PIN to continue payment.

- The buyer enters the 6-digit authentication code, which is sent to the mobile number registered to Tamara, to complete the payment.

- The buyer is redirected back to the merchant result page.

Supported online payment integrations

Antom offers a range of integration options tailored to each payment method. Each payment method may support different online payment integration options, allowing for flexibility based on your business requirements. The table below provides detailed information about the specific integrations available for each payment method: