Revenue Booster for card payments

Antom Revenue Booster enhances payment success rates by delivering tailored recommendations that align with your business needs. It now empowers merchants across e-commerce, travel, and digital entertainment sectors, significantly boosting their credit card approval rates and driving revenue and sales growth.

Antom Revenue Booster leverages value-added services provided by the card scheme (such as network tokens and adaptive message) and utilizes an AI-powered optimization engine to identify transaction characteristics. This helps you optimize ISO messages, retry logic, and routing strategies to enhance the payment success rate. As a result, you can maximize the benefits of your payment processes while minimizing the time spent on operational tasks.

Antom Revenue Booster offers the following services to enhance your payment performance:

- Credential Lifecycle Management:

Credential Lifecycle Management

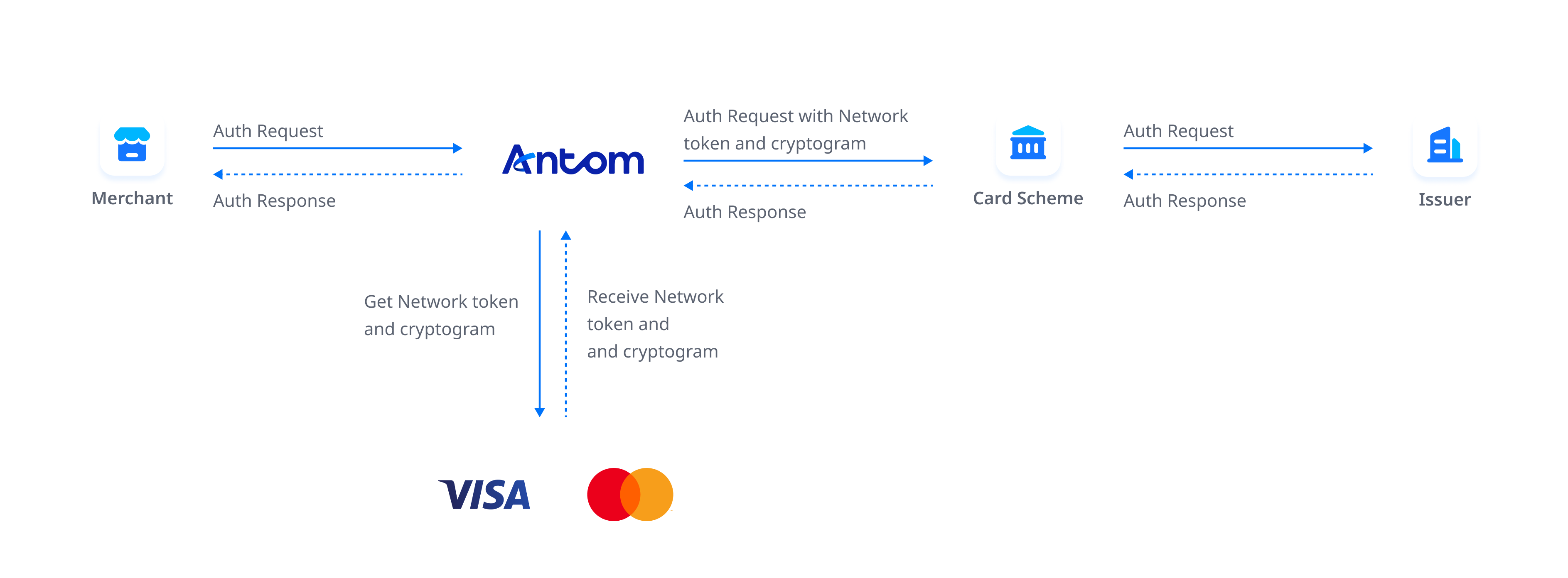

Network Tokenization

Network tokens are 16-digit substitutes issued by card schemes to replace the card's Primary Account Number (PAN).

While PANs are universally usable across merchants and thus vulnerable to fraud, network tokens are merchant-specific and unique, significantly reducing transaction risks. The table below compares network tokens with primary account numbers (PANs):

Feature | Usage Scope | Security |

PAN | Universal across merchants | High risk |

Network token | Merchant-specific | Low risk |

Advantages

- Dual-layer tokenization: Antom facilitates the application of PAN tokens from payment networks (Visa, Mastercard). During authorization, it securely swaps PANs with network tokens using one-time keys. Additionally, Antom’s proprietary tokenization technology replaces PANs with Antom tokens before reaching the network. It means your buyer's PAN can be swapped and stored as an Antom token before reaching the payment network, further enhancing transaction security.

- AI-Driven optimization: Antom intelligently selects between PANs and network tokens based on issuer preferences, maximizing approval rates.

- End-to-end lifecycle management: Antom manages the full lifecycle of network tokens. If your buyers are issued a new PAN due to a lost, stolen, or expired card, the system automatically updates the token upon notification from the payment network. It also proactively requests a new token if the existing one becomes invalid.

Benefits

- Higher approval rates: Network tokens typically achieve higher authorization rates than PAN. For instance, when an issuer updates the underlying PAN due to fraud concerns, the same token can automatically link to the new PAN without requiring cardholder intervention, significantly boosting approval rates for recurring transactions like renewals and installments.

- Enhanced compliance and security: By leveraging network tokens and Antom tokens, sensitive PAN data can be removed from your operations, ensuring PCI DSS compliance. Since network tokens use unique one-time codes for each transaction, the risk of token compromise is mitigated even if leaked.

- Cost efficiency: Antom's built-in tokenization eliminates the need for separate integration with payment networks, reducing expenses. Additionally, the 'interchange fee + pricing' model can lower interchange costs for tokenized transactions.

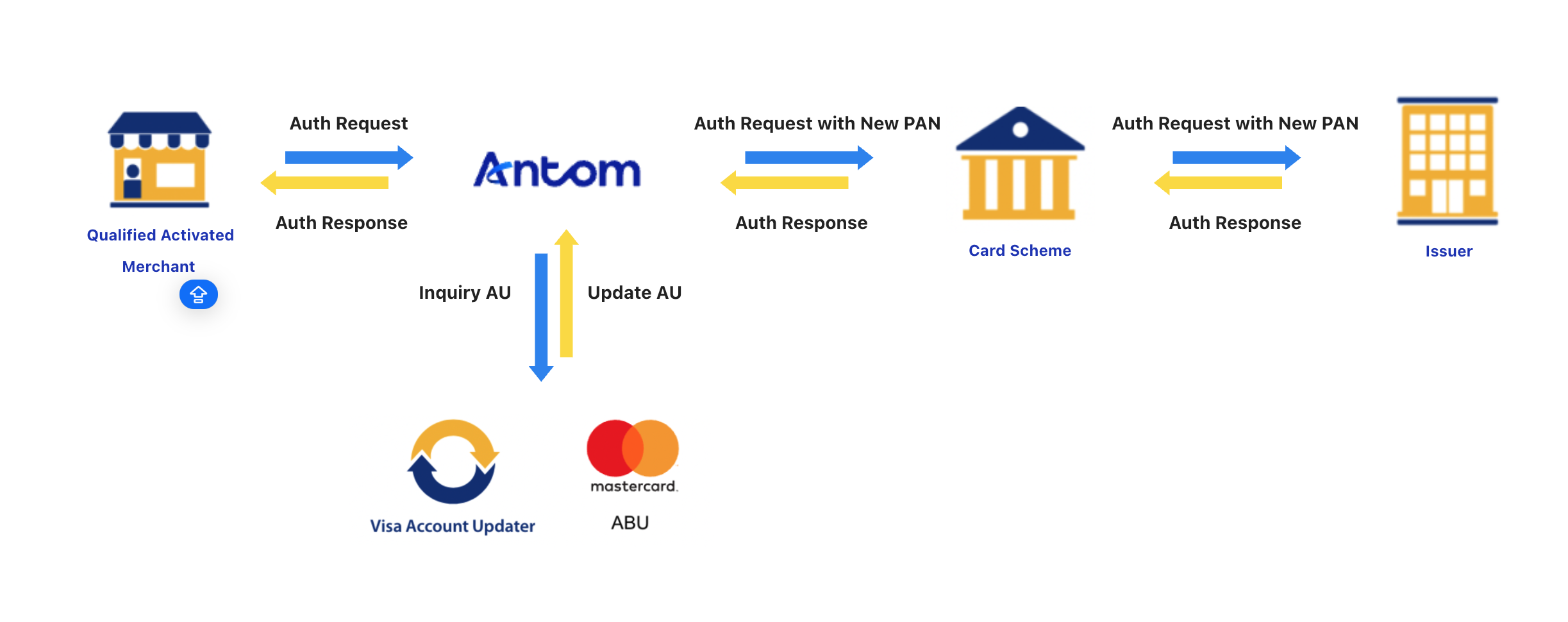

Account Updater

Account Updater (AU) refers to updating card information for transactions in order to obtain to the latest card status, avoiding transaction failures due to reasons such as changed card numbers or expired expiration dates, which would lead to a decrease in Authorization Rates. For Primary Account Number (PAN) transactions, so far, we have one method of updating: the real-time account updater.

Real Time Account Updater (RTAU) is an instant updating service that automatically updates the PAN whenever a transaction occurs, provided that the update conditions are met.

Advantages

- Automatic card information updates: Automatically refreshes card information, such as card numbers, expiration dates, and account statuses, when such changes occur. This ensures that merchants consistently have access to the most current card data. By maintaining updated card information, the service significantly reduces the number of failed transactions caused by outdated or invalid card details. This leads to higher approval rates and smoother transactions.

- Continuous lifecycle management: Provides merchants with ongoing updates throughout the entire lifecycle of the card, ensuring that any changes in card information are promptly reflected in the system without requiring manual intervention.

- Streamlined merchant activation: Easy activation process for merchants with no need for extensive integration efforts, enabling them to quickly start utilizing the service and reaping its benefits.

Benefits

Real-time Account Updater offers several benefits that are particularly valuable in the realm of payment processing, especially for credit and debit card transactions:

- Reduces transaction failures: When a buyer's card details change (such as card number, expiration date, etc.), real-time updates help ensure that merchants use the most current card information for transactions, thus reducing failures due to outdated information.

- Saves time and costs: Automatically updating card information saves both merchants and buyers time and process costs associated with handling expired or invalid card information.

- Increases revenue: By minimizing payment interruptions caused by expired or invalid cards, the likelihood of successful transactions increases, thereby boosting merchant revenues.

- Reduces customer attrition: Actively maintaining buyer account payment information reduces the risk of losing customers due to unsuccessful payment processing. Through these benefits, real-time Account Updater becomes a crucial tool for merchants looking to provide a stable and reliable payment experience while maintaining customer relationships.

Authentication Intelligence

Authentication Intelligence is the dynamic authentication engine. Our dynamic authentication engine intelligently applies authentication—complying with regulations like PSD2 (Payment Services Directive 2) in the European Union while maximizing conversion and minimizing friction. It automatically leverages all eligible exemptions, so buyers only complete step-up authentication when absolutely necessary.

Advantages

- Dynamic authentication strategy: Authentication Intelligence evaluates multiple factors—including risk, user convenience, local regulations, and issuer preferences—to determine the optimal authentication strategy, enabling a seamless and frictionless experience for customers.

- Alternative solution: Antom offers multiple 3DS solutions aligned with the EMVCo framework, including data-only and regional 3DS exemption options, providing flexible authentication coverage across different markets.

Benefits

- Higher frictionless rate: By intelligently selecting the most suitable authentication method, our solution ensures a smooth, frictionless checkout that boosts conversion rates.

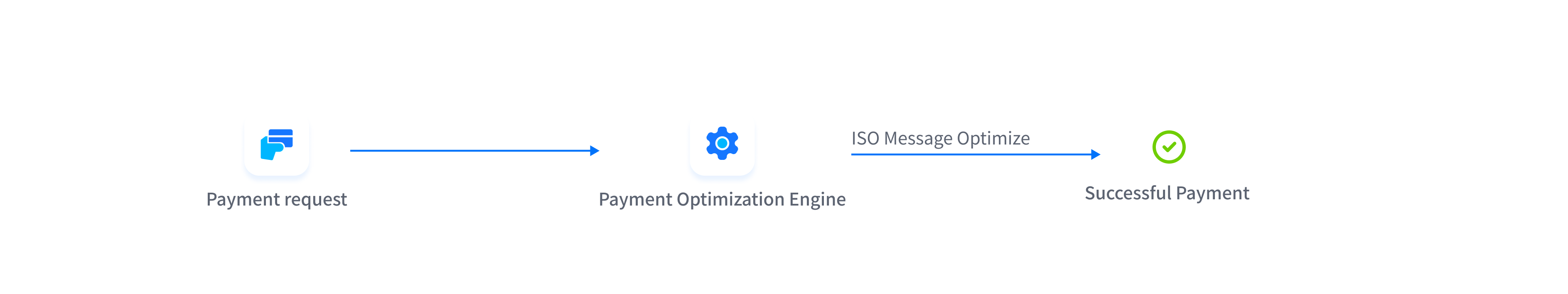

Adaptive Messaging

Adaptive Messaging is an innovative solution designed to enhance card payment success rates. From the perspective of industry experience, different card issuers have varied preferences when handling transactions based on different transaction elements. By conducting a comprehensive exploratory analysis of various real-time transaction characteristics and response data, the algorithm actively identifies the optimal combination of transaction elements.

Advantages

- Expert insights and model optimization: Utilize machine learning algorithms to analyze historical transaction data, identifying key factors that affect initial authorization success rates. Optimize authorization requests based on data models, increasing the likelihood of success while reducing unnecessary attempts.

- Intelligent authorization: Implement dynamic authorization strategies by adjusting request parameters based on real-time data. Provide customized rule configurations to optimize request strategies for different user groups and risk levels.

- Real-time monitoring and feedback: Offer real-time monitoring features to track the authorization status and success rate of each transaction. Provide immediate feedback to resolve potential issues.

- Rapid learning: Employ A/B testing methods to evaluate the effectiveness of different optimization strategies, identifying the most effective solutions.

Benefits

- Higher success rates: Smart systems adjust authorization requests based on historical transaction data, reducing failures from incorrect data.

- Increased merchant revenue: Successful first-time transactions drive repeat purchases and long-term customer value, increasing the success rate of first transactions directly contributes to merchant revenue and sales growth.

- Data-driven improvement: Collecting and analyzing data points related to first transactions provides insights for continually optimizing authorization decision rules. Antom adjusts strategies based on data feedback to enhance the success rate of future transactions.

- Multi-strategy support: Each transaction may have different contexts, intelligent decision-making allows for the combination of the comprehensive optimization features. This flexibility ensures merchants can improve success rates without compromising personalized service.

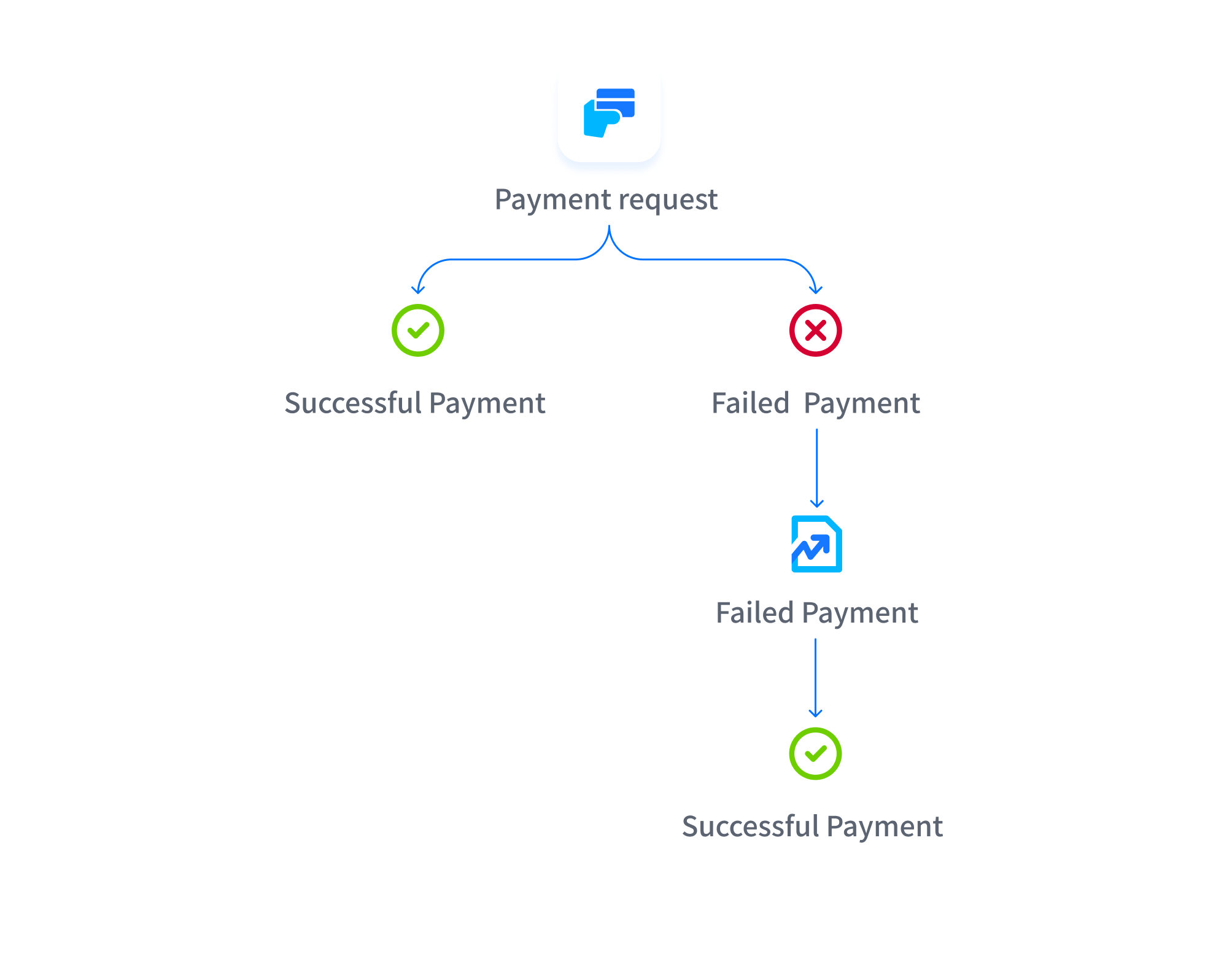

Active Retries

Online payments can fail for various reasons, such as technical glitches or customer-related issues. Antom Active Retry identifies potentially recoverable failed transactions and proactively attempts to complete them successfully.

Advantages

- AI-driven payment recovery: Analyzes real-time decline reasons and issuer trends to retry transactions within the recovery window.

- Rescue-to-optimization: Uses recovery data to refine initial payment strategies, boosting conversion rates and protecting revenue.

Benefits

- Proactive recovery: Attempts to salvage transactions likely to be accepted by issuers.

- Revenue protection: Prevents legitimate orders from being lost due to false fraud flags.

Smart Routing

Smart routing is an intelligent transaction routing engine that analyzes real-time card transaction data—such as transaction amount, region, and payment method—to select the optimal payment path, enhancing success rates, reducing costs, and ensuring a seamless payment experience.

Advantages

- Dynamic payment navigation: The system evaluates multiple payment channels in real time, factoring in issuer behavior, card type, region, and historical performance data to automatically select the most likely successful route. By leveraging machine learning to analyze past transaction outcomes, it continuously optimizes routing strategies, boosting approval rates while reducing processing costs.

Benefits

- Efficient routing decisions: Real-time optimization improves approval rates and reduces costs, enhancing conversion.

- Cost-effective co-branded and local card routing: Achieve cost savings through seamless route switching between global and local cards.