Introduction

With the Alipay user-presented mode payment product, an excellent payment experience can be provided. The customer presents the payment code generated by the customer wallet to the merchant and the merchant scans the payment code to initiate a payment to the acquirer. The payment speed and efficiency are greatly improved because the merchant can lower the error rate in the payment process by specifying the payment amount with the cash register and the merchant can get a clear payment result for each transaction. Even when the mobile phone for payment is with weak network signal or no network signal, the payment can be made successfully.

Benefits

Alipay user-presented mode payment product provides the following benefits to partners:

- One-point access, global income: Supports the merchant to accept global payments and obtain global customers, which leads to an increase of transactions and revenue.

- Low cost integration: No additional integration costs needed when you add new wallet product to expand your business after integrating Alipay the first time.

- Powerful risk management: Powerful risk control engine offered, managing the risks of buyers, sellers, and transactions and ensuring the security of funds.

- Best exchange rate: Competitive exchange rates provided, helping merchants to get more transactions.

- Multi-currency settlement: Multiple settlement currencies supported. Accept settlement with the currency of your choice.

- Comprehensive Merchant Service: Timely and comprehensive support and assistance to buyers and sellers around the world.

User experience

The Alipay user-presented mode payment product provides a convenient and secure way to pay. Customers can complete the payment in just a few easy steps:

- The customer presents the payment code for payment to the merchant.

- The merchant scans the payment code to collect the payment.

- The customer gets the payment result.

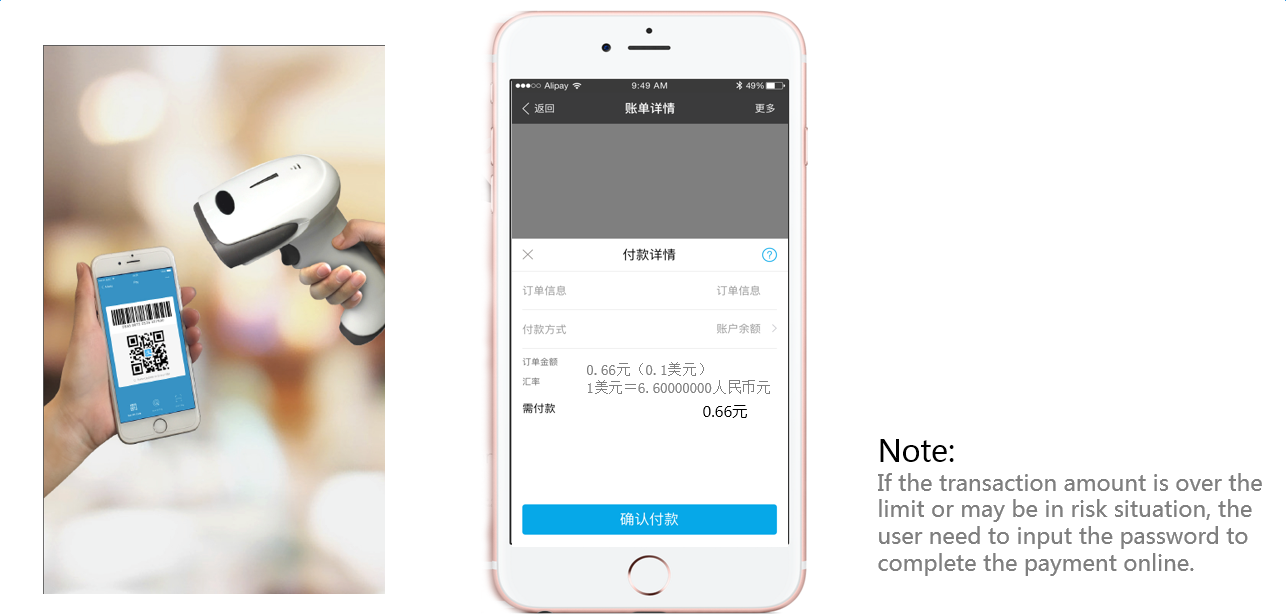

Figure 1. User experience with no payment password required

If the transaction amount is over the limit or risks might exist, the customer might be required to enter the payment password to complete the payment:

- The customer presents the payment code for payment to the merchant.

- The merchant scans the payment code and the checkout page is triggered.

- The customer enters the password and complete the payment.

Figure 2. User experience with payment password required

Product flow

The merchant scans the payment code for payment and initiates a payment request to Alipay. Alipay sends the payment request to PMP. PMP returns the payment result to Alipay after processing the payment and sends the payment result to the customer. After getting the payment result from PMP, Alipay sends the payment result to the merchant.

Figure 3. User-presented mode payment product flow

In the Alipay user-presented mode payment product, the following four roles are involved:

- User: An individual or institution that uses the payment service. The customer's funds are ultimately delivered to the merchant through the payment service provider.

- Merchant: A company or individual that trades on goods or services. The acquiring institution will settle the funds to the merchants on a regular basis.

- Alipay: Alipay merchant service, provided by Alipay.

- PMP: Payment method provider, an organization that processes payment services and other value-added services on behalf of the payer.

Three integration modes are provided for implementing the integration: integration by the merchant, integration by the system integrator, and integration by ISV. For more details, see Integration mode.

Product features

Use the user-presented mode payment product when the following criteria are matched:

Features | Value |

Payment type | Offline payment |

Payment initiator | Merchant |

User authorization provider | Payment Method Provider (PMP) |

User authorization method | User authorization provided by PMP |

Terminal type | Scan device that supports 24-digit length payment code or QR code |

Payment code owner | User |

Payment code issuer | PMP |

Table 1. Service criteria

Terms and definitions

These terms and corresponding definitions are important or frequently used in the user-presented mode payment product:

- Acquirer (ACQ): Institution that processes payments on behalf of Merchants.

- Code issuer: A party that complies with this standard. It usually has the ability to decode and obtain the business information associated with the code.

- In-store payment: The activity that a user goes to a merchant's place of business and conducts face-to-face payments with the merchant.

- User-presented Mode payment: A payment initiated by the merchant that scans the user-presented code with devices.

- Payment code: Also known as business-scan-user code or user-presented code, which is the QR code or barcode presented by users for merchants to scan with their reading devices to initiate payments.

- QR code: Quick Response Code as defined in ISO/IEC 18004.